S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Best time to invest in m3m GIC...

Blogs

Best time to invest in m3m GIC Gurgaon International city Manesar

Understanding M3M GIC and Why Timing Matters

When it comes to real estate, especially high-value integrated townships like M3M GIC – Gurgaon International City, timing your investment correctly can dramatically affect your return on investment (ROI). Investors often ask: “When should I invest to get the best appreciation?” This guide breaks down everything—from project details and connectivity to market dynamics and strategic investment windows—so you can make a well-informed decision.

M3M GIC is a premium residential and mixed-use township being developed by M3M India in Sector 9, Manesar, Gurugram (National Capital Region – NCR). The project spans roughly 140–150+ acres and is planned to include residential apartments, commercial spaces, and industrial plots, integrated within a larger master community.

Strategic connectivity, promising infrastructure, and the scale of this development have positioned it as a potential growth hotspot. Yet, before digging deeper into when to invest, we must review what the project offers and why it attracts investors.

🧱 Chapter 1: Project Overview – What Is M3M GIC?

🏡 What You Get with M3M GIC

M3M GIC (Gurgaon International City) is conceptualized as a mixed-use township with a premium residential segment and integrated lifestyle features:

-

Luxury apartments (2/3/3.5/4 BHK) with modern design and amenity-rich living.

-

World-class lifestyle amenities such as clubhouses, swimming pools, green zones, fitness spaces, and children’s areas within the community.

-

Industrial & commercial zones cultivating jobs, retail demand, and a self-sustainable ecosystem.

-

Large open spaces and green planning, enabling a quality living environment.

The township is positioned to be a live-work-play ecosystem that attracts residents, professionals, tenants, and businesses alike, combining lifestyle appeal with strong long-term fundamentals.

🏗️ Current Status

-

M3M GIC is in the early launch and construction phase, with possession currently expected around 2029–2030.

-

Early pricing and entry advantages (e.g., Expression of Interest to secure priority slots) are available but limited in volume—a key factor influencing purchase timing.

🛣️ Chapter 2: Why Location and Connectivity Are Critical to ROI

🚆 Strategic Connectivity

M3M GIC’s location in Manesar places it at the intersection of multiple growth drivers:

-

NH-48 (Delhi–Gurgaon–Jaipur Highway) for seamless travel.

-

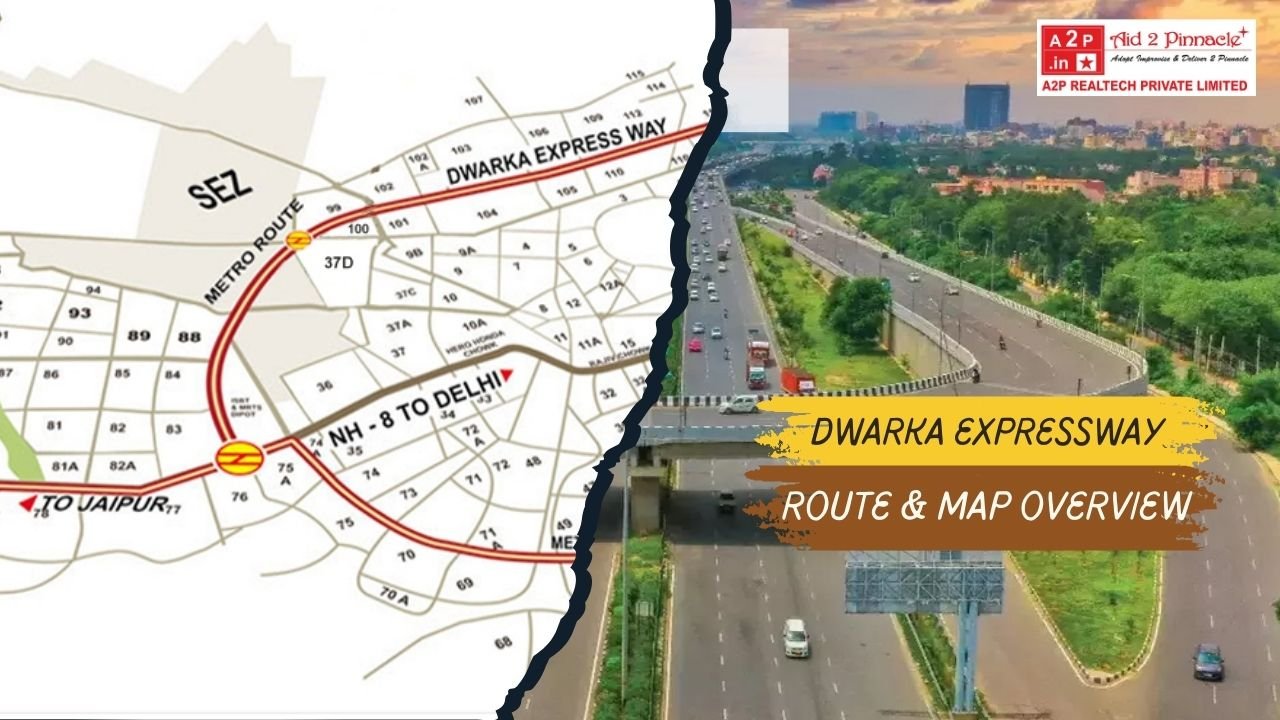

Dwarka Expressway connectivity, which has already significantly boosted property values across regions it touches.

-

KMP (Kundli-Manesar-Palwal) Expressway improving access within NCR.

-

Future Proposed metro lines and improved public transit options projected to enhance connectivity and demand.

📌 Transportation linkages are among the top real estate ROI drivers, because they directly influence daily commute times, work-life convenience, and investor confidence.

📈 Impact of Connectivity on Property Prices

Research and market reports show that property prices along major corridors like Dwarka Expressway nearly doubled over a four-year period, largely due to enhanced connectivity and infrastructure completion.

This demonstrates a pattern where investment ahead of or during infrastructure completion phases often yields substantial value appreciation—an important insight for timing your investment.

⏱️ Chapter 3: What Affects Real Estate Price Appreciation

Investors frequently wonder why property value increases occur at certain times. The main factors include:

📊 1. Infrastructure Completion

Properties often see accelerated value increases as key infrastructure projects (roads, expressways, metro, public transit) reach completion. For example, once projects like the ongoing metro extension and expressway enhancements are operational, daily accessibility rises—prompting demand and price spikes.

📈 2. Supply and Demand Dynamics

New launches like M3M GIC attract early adopters, but as inventory decreases and demand increases, prices tend to increase. Limited launch offers and priority pricing are designed to drive early commitments.

🧠 3. Economic & Market Sentiment

Macroeconomic factors (interest rates, lending climate, investor confidence) affect buying decisions. A stable economic environment generally supports property demand and better ROI potential.

🪪 4. Developer Reputation and Delivery Track Record

M3M is a well-known brand in the Indian real estate market. Reputation matters, because buyers trust timelines and quality, which in turn maintains buyer interest and supporting price trends.

📅 Chapter 4: Best Investment Timing Windows

Here are the critical investment timeframes you should consider:

📍 ⏱️ 1. Early Launch Phase – Best Entry Prices (2025–2026)

Why this period is attractive:

-

Lowest base pricing and priority unit selection.

-

Potential for higher capital appreciation once major milestones are announced or construction progresses.

-

Investors during this phase often reap the most price appreciation when compared to later entry points.

➡️ Real estate history (including examples from Dwarka Expressway and similar high-growth corridors) shows that prices appreciate significantly once infrastructure or connectivity milestones near completion—sometimes double or more from launch prices.

💡 Investor Tip: If you are targeting maximum long-term ROI, entering at or near the launch phase typically produces the largest absolute gain, albeit with a longer holding period.

📍 ⏱️ 2. Infrastructure Breakthrough Phase – Midway Growth (2027–2028)

As the project progresses and regional connectivity improves through expressways and proposed metro links:

-

Market confidence increases.

-

Buyers start treating properties as nearer to end-use rather than speculative assets.

-

Price increases tend to accelerate.

This is often where many investors choose to exit to secure profits if they are targeting a medium-term timeframe (3–4 years).

📍 ⏱️ 3. Pre-Possession Phase – Near Peak Demand (2029–2030)

As possession nears:

-

Demand shifts from early speculators to end-users.

-

Prices generally peak because people are ready to live or lease.

-

Rental demand strengthens.

Investors holding till this stage can often achieve strong ROI through capital gains + rental yield.

💰 Chapter 5: Estimating ROI Potential Over Time

While precise ROI figures depend on eventual market conditions, historical patterns in similar corridors suggest:

-

Early investors tend to see higher percentage appreciation as infrastructure completes.

-

Mid-term holders benefit as demand sentiment changes from speculative to end-user demand.

-

Long-term holders around the possession phase usually capture strong price realizations plus rental returns.

For example: Analysts forecast property values in high-growth Gurugram corridors could increase by 30–60% over a 5–year period (based on analogous corridors such as Dwarka Expressway).

🏬 Chapter 6: Practical Investment Considerations

🧠 1. Payment Plan and Cash Flow

M3M GIC offers flexible payment plans (e.g., 15:75, early bird entry returns, etc.), which help spread your cost over years rather than upfront.

This helps manage liquidity while securing a foothold early.

📉 2. Holding Period

-

Short-term investors (1–3 yrs): Might see modest gains, but also face construction risks or slower early growth.

-

Mid-term investors (3–5 yrs): Better capture growth as connectivity solidifies and inventory tightens.

-

Long-term investors (5+ yrs): Enjoy peak appreciation near possession and strong rental demand.

📌 3. Rental Income Potential

As the region develops, rental demand from professionals working in nearby industrial and commercial hubs (e.g., IMT Manesar) is expected to increase—offering steady rental yields.

🤝 4. Developer Reliability

Always review:

-

RERA registration and compliance.

-

Construction progress.

-

Developer track record on delivery timelines.

🌟 Optimal Investment Strategies for Maximum ROI

Based on current project status, connectivity enhancements, and real estate trends:

✅ Best Overall Window:

Early launch to mid-2026.

Why? This phase offers the best balance of low entry price, unit selection, and future price appreciation potential.

📈 Secondary Target Window:

2027–2028.

Ideal for investors who want moderate growth with reduced construction risk and clearer infrastructure timelines.

📊 Long-Term Growth Strategy:

Hold until 2029–2030 to capitalize on peak demand as possession nears, then consider selling or renting.

Latest Posts

-

-

by Admin The Survival of Affordable Hou...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...

.png)