S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

Blogs

Social Media Share

Exploring Investment Options in M3M SCO 113 Market for Maximum Returns says A2P Realtech

Investment Options in M3M SCO 113 Market Dwarka Expressway for Maximum Returns says A2P Realtech

Looking for lucrative investment opportunities in the real estate market? Look no further than M3M SCO 113 Market. A2P Realtech, a trusted name in the industry, recommends exploring this prime location for maximum returns. With its strategic location, state-of-the-art infrastructure, and high-footfall, M3M SCO 113 Market promises to be a goldmine for investors.

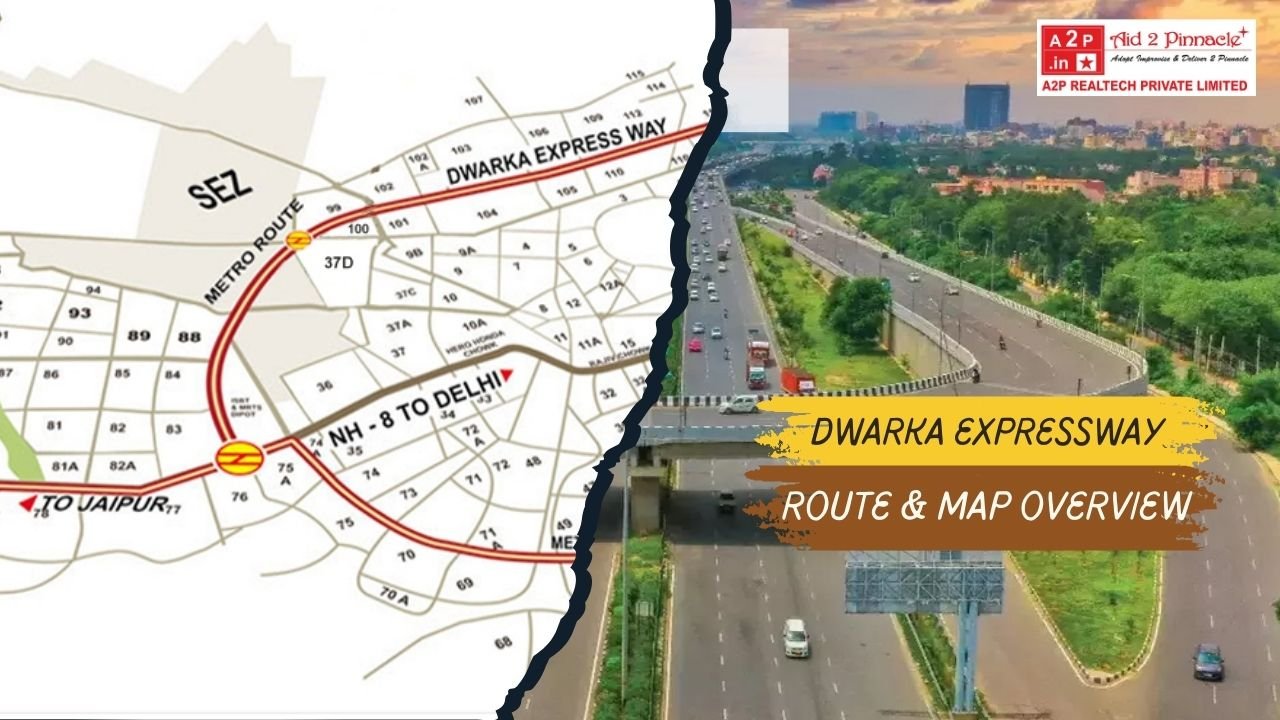

Situated in a rapidly developing area, M3M SCO 113 Market is surrounded by residential complexes, commercial spaces, and office hubs. Its proximity to major highways ensures excellent connectivity, attracting a large number of potential customers. Additionally, the market offers a wide range of options, from retail spaces to showrooms, ensuring there is something to suit every investor's needs.

A2P Realtech, known for their extensive knowledge and expertise in the real estate sector, has identified M3M SCO 113 Market as a prime investment opportunity. By choosing to invest in this market, you can be confident in the potential for high returns and long-term growth.

Take advantage of the booming real estate market and explore the investment options available in M3M SCO 113 Market today. With A2P Realtech's guidance, you can maximize your investment and secure a prosperous future.

Understanding the concept of investment options

Investment options refer to the various avenues available for individuals and organizations to allocate their capital with the expectation of generating returns over time. These options can range from traditional assets like stocks and bonds to alternative investments such as real estate, commodities, and mutual funds. Understanding the different types of investment options is crucial for making informed financial decisions that align with one’s risk tolerance, investment horizon, and financial goals.

In the context of real estate, investment options can include residential properties, commercial properties, and mixed-use developments. Each of these categories presents unique opportunities and challenges. For instance, residential properties typically offer stable, long-term rental income, while commercial properties, like those in M3M SCO 113 Market, can provide higher returns but may also come with increased risks due to market fluctuations and tenant turnover. The key is to evaluate these options carefully to determine which aligns best with the investor's objectives.

Additionally, the location plays a vital role in shaping the potential success of an investment. Prime locations, such as M3M SCO 113 Market, can enhance the attractiveness of the investment option significantly. This market's strategic positioning near residential complexes and major highways can drive foot traffic and, consequently, sales, making it a lucrative choice for those looking to invest in real estate. Understanding investment options allows investors to diversify their portfolios and mitigate risks while maximizing potential returns.

Why invest in M3M SCO 113 Market?

Investing in M3M SCO 113 Market presents a unique opportunity for both seasoned and novice investors. One of the primary reasons to consider this location is its strategic positioning in a rapidly developing area. The market is surrounded by a plethora of residential complexes, commercial spaces, and office hubs, ensuring a steady influx of potential customers. This high footfall translates into increased sales for retailers and service providers, creating a vibrant economic environment conducive to growth.

Another compelling reason to invest in M3M SCO 113 Market is the state-of-the-art infrastructure that supports business operations. The developers have designed a modern marketplace equipped with essential amenities, ensuring that businesses can operate efficiently. From ample parking facilities to well-planned layouts, M3M SCO 113 Market is designed to cater to both consumers and business owners alike. Such infrastructure not only enhances the customer experience but also adds value to the investment, making it a desirable location for businesses.

Moreover, the real estate market in this area is on an upward trajectory, driven by increasing demand for commercial spaces as more businesses seek to establish their presence. With urbanization and population growth, the need for retail and commercial spaces is expected to rise, providing a favorable environment for investors. By investing in M3M SCO 113 Market, investors can capitalize on this trend, positioning themselves for substantial returns in the long run.

Factors to consider before investing in M3M SCO 113 Market

Before making an investment in M3M SCO 113 Market, it's essential to evaluate several critical factors that can impact the potential success of the investment. First and foremost, conducting thorough market research is vital. Understanding the demographics of the area, including population growth, income levels, and consumer behavior, can provide valuable insights into the market's viability. Investors should look into the types of businesses that are thriving in the vicinity to gauge the potential for success in their investment.

Another important consideration is the financial aspects of the investment. Investors should have a clear understanding of the costs involved, including purchase prices, maintenance expenses, and potential taxes. It's also wise to assess the potential rental income or resale value to ensure that the investment aligns with their financial goals. Creating a detailed budget and financial plan can help investors avoid unforeseen expenses and make informed decisions.

Lastly, it’s crucial to evaluate the legal and regulatory landscape surrounding real estate investments in the area. Understanding zoning laws, property taxes, and any restrictions on commercial activities can impact the feasibility of executing business plans within M3M SCO 113 Market. Engaging with legal experts or real estate consultants can provide clarity and guidance in navigating these complexities, ensuring that investors are well-prepared for any challenges that may arise.

Exploring the potential returns in M3M SCO 113 Market

The potential returns on investment in M3M SCO 113 Market can be quite promising, particularly when compared to other investment options within the real estate sector. The market's strategic location, combined with its modern infrastructure, creates an environment ripe for business growth and profitability. Investors can expect a healthy return on their investment through rental income, capital appreciation, or both, depending on how they choose to leverage their property.

Rental income is often the primary source of returns for real estate investors. In M3M SCO 113 Market, the high footfall and diverse consumer base create an attractive proposition for retailers and service providers, leading to competitive rental rates. As demand for commercial space continues to rise, investors can anticipate consistent rental income that can ultimately exceed initial projections. This steady cash flow can be particularly beneficial for those seeking to generate passive income through their investments.

In addition to rental income, capital appreciation is another significant factor contributing to potential returns. Given the ongoing development and urbanization in the area surrounding M3M SCO 113 Market, property values are likely to increase over time. Investors who purchase properties now may benefit from substantial appreciation as the market matures, leading to lucrative resale opportunities in the future. By carefully assessing market trends and timing their investments wisely, investors can maximize their financial gains in this burgeoning market.

Risks associated with investing in M3M SCO 113 Market

While there are numerous opportunities for profit within M3M SCO 113 Market, it's essential to acknowledge the risks associated with real estate investments. Understanding these risks allows investors to make informed decisions and prepare for potential challenges. One significant risk is market volatility, which can be influenced by various factors such as economic downturns, changes in consumer preferences, or shifts in local demographics. Such fluctuations can lead to reduced demand for retail spaces, affecting rental income and property values.

Another risk to consider is the possibility of tenant turnover. In commercial real estate, tenant retention is crucial for maintaining stable cash flow. If businesses within M3M SCO 113 Market struggle or fail, investors may face vacancies that can lead to financial losses. It’s important for investors to conduct thorough due diligence on potential tenants, ensuring they have a solid business plan and financial stability. Implementing effective property management strategies can also help mitigate this risk by fostering positive relationships with tenants and maintaining high occupancy rates.

Lastly, regulatory and legal risks must be taken into account. Changes in zoning laws, property taxes, or other regulations can impact the profitability of the investment. Investors should stay informed about local regulations and engage with professionals who can provide legal advice. By proactively addressing these risks and developing contingency plans, investors can better navigate the uncertainties of the real estate market and safeguard their investments.

Tips for maximizing returns in M3M SCO 113 Market

To unlock the full potential of investments in M3M SCO 113 Market, investors can adopt several strategies aimed at maximizing returns. First, thorough market research is paramount. By understanding market trends, customer preferences, and competitor analysis, investors can make strategic decisions that align with demand. For instance, identifying the types of retail spaces that are gaining popularity can guide investment choices and ensure alignment with consumer needs.

Another effective strategy is to enhance the value of the property through renovations and upgrades. Improving the aesthetics, functionality, and amenities of a commercial space can attract quality tenants and justify higher rental rates. Additionally, creating a unique branding experience for businesses within M3M SCO 113 Market can enhance the customer experience and drive foot traffic, ultimately benefiting all stakeholders involved.

Moreover, engaging with a skilled property management team can significantly contribute to maximizing returns. Professional property managers possess the expertise to handle tenant relations, marketing, and maintenance, ensuring that the investment runs smoothly. They can also assist in implementing effective marketing strategies that highlight the advantages of the location, attracting potential tenants and customers. By focusing on these areas, investors can cultivate a thriving business environment that enhances profitability in M3M SCO 113 Market.

Overview of A2P Realtech and their expertise in M3M SCO 113 Market

A2P Realtech stands out as a reputable player in the real estate industry, renowned for its extensive expertise and commitment to client success. With a team of experienced professionals who possess in-depth knowledge of the real estate market, A2P Realtech specializes in identifying prime investment opportunities, including those in M3M SCO 113 Market. Their dedication to thorough research and analysis allows them to provide valuable insights that empower investors to make informed decisions.

The firm's proficiency in navigating the complexities of the real estate landscape is underscored by their track record of successful investments. A2P Realtech employs a strategic approach, combining market analysis with tailored investment strategies to align with the specific needs and goals of their clients. Their expertise in M3M SCO 113 Market positions them as a trusted partner for investors seeking to capitalize on the immense potential of this thriving commercial hub.

In addition to investment advisory services, A2P Realtech offers comprehensive support throughout the investment journey. From property acquisition to management, they take a holistic approach to ensure that clients receive the guidance necessary to maximize their returns. By leveraging their extensive network and knowledge of local market dynamics, A2P Realtech is well-equipped to help investors navigate the opportunities and challenges associated with investing in M3M SCO 113 Market.

Services offered by A2P Realtech for investors in M3M SCO 113 Market

A2P Realtech provides a suite of services designed to support investors in capitalizing on the opportunities presented by M3M SCO 113 Market. One of their primary services is investment advisory, where they conduct thorough market research and analysis to identify the best investment opportunities. This service includes evaluating potential properties, assessing market trends, and providing insights into rental income potential and capital appreciation.

Additionally, A2P Realtech offers property management services, which are crucial for maintaining the value of investments in a competitive market. Their team handles tenant relations, property maintenance, and marketing efforts, ensuring that properties remain attractive to prospective tenants. By managing day-to-day operations, A2P Realtech allows investors to focus on strategic decisions while maximizing their rental income and minimizing vacancy periods.

Furthermore, A2P Realtech provides legal and regulatory support, guiding investors through the complexities of property ownership. Understanding local regulations, zoning laws, and compliance requirements is essential for successful investments. The firm's expertise in these areas ensures that investors are well-informed and prepared to navigate any legal challenges that may arise. With A2P Realtech's comprehensive services, investors can feel confident in their decisions and maximize their investment potential in M3M SCO 113 Market.

Conclusion and final thoughts

In conclusion, M3M SCO 113 Market presents a compelling investment opportunity for those looking to enter the real estate sector. The strategic location, modern infrastructure, and potential for high returns make it an attractive choice for investors. However, it is crucial to approach this investment with a clear understanding of the various factors at play, including market dynamics, potential risks, and the importance of thorough research.

With expert guidance from A2P Realtech, investors can navigate the complexities of the market confidently. Their extensive knowledge and experience provide a valuable resource for those looking to maximize their returns in M3M SCO 113 Market. By leveraging the insights and support offered by A2P Realtech, investors can make informed decisions that align with their financial goals, ensuring a prosperous investment journey.

As the real estate market continues to evolve, staying informed and adaptable will be key to success. By embracing the opportunities presented by M3M SCO 113 Market and collaborating with reputable partners like A2P Realtech, investors can position themselves for long-term growth and profitability in this vibrant marketplace.

.jpg)

.png)