S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

Blogs

Social Media Share

Flats Near Dwarka Expressway

Flats Near Dwarka Expressway 2025 | Best Real Estate Investment Guide

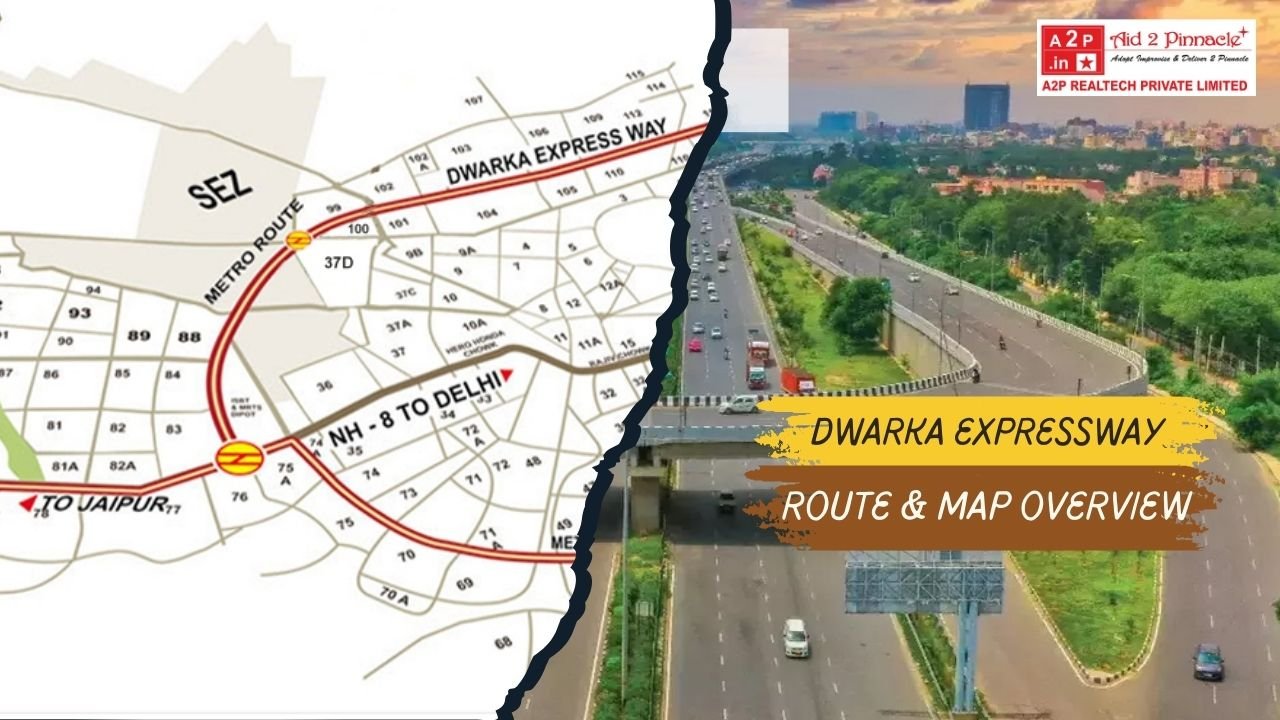

The futuristic access-controlled corridor of the Dwarka Expressway, linking Delhi’s Dwarka sub-city with Gurugram in Haryana, has rapidly emerged as one of the most sought-after residential and investment zones in the NCR region. With major connectivity upgrades nearing completion and a strong pipeline of residential projects, the year 2025 presents a unique opportunity for both home-seekers and investors to tap into flats near this expressway.

Whether you’re looking for a serene home for your family or a high‐return real‐estate investment, flats along the Dwarka Expressway offer a blend of location, infrastructure, and lifestyle that’s hard to match elsewhere. This guide delves into the why, where, how, pricing, risks, and strategies you should consider.

1. Why Flats Near Dwarka Expressway Are Gaining Traction

a) Connectivity That’s Transforming the Corridor

The Dwarka Expressway isn’t simply another road; it’s a strategic transport artery that significantly reduces travel times between Delhi, Gurugram and key nodes such as the Indira Gandhi International Airport (IGI). Improved access to major employment hubs, metro lines, and proposed transit systems has elevated the appeal of flats here.

b) Strong Appreciation & Growing Demand

Multiple reports confirm a rapid increase in property values along this corridor. According to one study, prices rose from about ₹9,434 per sq ft in 2020 to around ₹18,668 per sq ft in 2024 — nearly doubling in four years. For investors and home-buyers alike, this shows that the market recognises the corridor’s long-term potential.

c) Diverse Segments – From Mid-Budget to Luxury

The corridor caters to a wide spectrum of home-buyers: mid-segment flats for families and first-time buyers, premium apartments for professionals, and luxury towers for high-net-worth individuals. This depth of supply means more choice, better competition, and potentially better deals.

d) Future-proofing: Amenities + Infrastructure

Beyond just apartments, the region is being transformed by metro extensions, transit-oriented developments, retail and social infrastructure (schools, hospitals, malls). These factors amplify livability and resell/rental value.

2. Location Snapshot: Which Sectors & Zones to Choose

To make the right choice, it helps to break down the corridor into distinct zones and sectors:

● Delhi side & border sectors

Sectors closer to the city, near Dwarka Sub-City and the expressway entry offer premium living with shorter commutes into Delhi. Ideal for end-users.

● Gurugram side – key sectors

On the Gurugram side, sectors like 102, 104, 106, 108, 109, 113 are especially in focus. These sectors combine expressway frontage, upcoming transit links, and high-end project launches.

● Newer sectors & township zones

Further out, sectors in the mid-corridor (e.g., 95–100) offer more budget-friendly options and may provide higher upside over longer term as infrastructure catches up.

When evaluating a flat, consider: proximity to the expressway, direct access to main road/feeder, connectivity to metro or transit stations, presence of schools/hospitals, and orientation (view, open space).

3. Price Trends & What You Should Know for 2025

a) Current Pricing Snapshot

Recent data indicates the following approximate rates:

-

Typical resale/new flats: ~₹18,000 per sq ft and above in prime sectors.

-

New launches/under-construction commanding ₹20,000–₹25,000 per sq ft or more in luxury segments.

-

Mid-segment sectors may still be available in the ₹15,000–₹18,000 per sq ft range.

b) Appreciation Outlook

Given the past rapid rise and upcoming infrastructure completion, many analysts predict further appreciation of 15%-25% over the next 12-24 months.

However, it’s important to calibrate expectations: the base has already risen. The rate of growth may moderate compared to earlier years.

c) Ticket Size & Affordability

For example, a typical 3 BHK flat in sectors like 104/109/113 may cost anywhere between ₹ 3 Crore to ₹ 4–5 Crore depending on size, finish, project status. First-time buyers should also factor in hidden costs: parking, club membership, maintenance, GST/transfer charges.

Dream Homes in Dwarka Expressway Projects

4. Types of Flats – Which Segment Should You Pick?

i) Mid-Segment Family Flats

Good option for resident buyers: 2/3 BHK flats in well-planned projects with amenities. Prioritise sectors where infrastructure is live, not too far off.

ii) Premium / Luxury Apartments

4 BHK+ apartments, large floor-plates, high-end finishes, top-tier amenities. Suitable for HNIs or for long-term investment where you may flip or rent out at premium rates.

iii) Ready & Near-Possession vs Under-Construction

-

Ready/Near-Possession: Lower risk, potential rental income sooner.

-

Under-Construction: Better entry price, greater appreciation potential, but higher risk (delay, cost escalation).

iv) Rental Potential

Flats close to major employment hubs, airport, or good amenities will generate consistent tenant demand. For investmentbuyers, aim for a balance of location + project credibility.

5. Choosing the Right Flat – Checklist for Buyers

Here’s a detailed checklist to help you evaluate flats along the Dwarka Expressway corridor:

-

Project & Developer: Check past track record, on-time delivery, quality of construction.

-

RERA & Approvals: Verify RERA registration, sanction plans, occupancy certificate timeline.

-

Sector & Road Frontage: Is the project directly on or immediately adjacent to the expressway? What is the approach road like?

-

Connectivity & Infrastructure: Distance to expressway access, metro station, retail hub, schools, hospital.

-

Apartment Layout & View: Floor size, orientation (north/south/east), number of units per floor, open space around.

-

Timeline & Possession Status: When is the project expected to be delivered? What are the penalties for delay?

-

Cost Components: Base price + development/maintenance charges + GST + parking + club membership.

-

Rental/Resale Prospects: What kind of tenants does the flat attract? What has the demand been like?

-

Amenities & Open Space: Green area, club house, pool, parking, children’s area.

-

Maintenance & Community Management: Established societies with good occupancy will have better living standards.

-

Risk Factors: Infrastructure still under development, traffic/approach road congestion, hidden cost escalation.

6. Top Risks & What to Watch Out For

While the corridor offers compelling advantages, no investment is without risk. Here are some things to keep an eye on:

-

Possession Delays: Many projects may still face delays due to execution or regulatory issues.

-

Infrastructure Gaps: Some feeder roads, internal service roads, metro lines may still be under construction — the “full benefit” may take years.

-

Price Over‐valuation: With rapid past growth, some projects may already reflect much of the value — margin for further upside might be smaller.

-

Liquidity concerns: Very premium units may have smaller pool of buyers/resale market; ensure you pick right size/configuration.

-

Affordability squeeze: As prices rise, middle-income buyers may get priced out, impacting demand at certain segments.

-

Utility & Social Infra: Some newer sectors may still lack full social infrastructure (schools, hospitals, public transport). Always check live status.

7. Investment Strategy: How to Maximise Your Returns

Strategy for Home-Seekers

If you are buying primarily to live in: choose a project that is ready or near-possession, good social infra, convenient for your commute. Accept a slightly lower appreciation in favour of quality of life.

Strategy for Investors

If your focus is on return:

-

Enter in sectors where infrastructure is upcoming but visible (metro/road) — earlier you get in, higher the upside.

-

Opt for mid-segment 3 BHK flats which appeal to a larger tenant/purchaser pool.

-

Ensure the project is reputable, occupiable and rentable to hold till demand matures (3-5 years).

-

Exit when the “trigger events” happen (full expressway operational, metro link live, major commercial hub launched) as these drive big value jumps.

Size & Configuration Tips

-

2/3 BHK tend to have broader appeal for families and tenants; 4 BHK+ may offer higher ticket but narrower demand.

-

Lower floors may cost less but may face more traffic/road noise; higher floors get better views but cost more.

-

South/East facing may offer good sunlight and ventilation — that often adds to value.

8. What to Expect in 2025 & Beyond

-

Many metro & transit-oriented developments are scheduled or underway, which when operational will further boost value.

-

Some sectors will mature faster (those nearer to Delhi border, expressway entry) and may witness premiumisation.

-

Mid-segment segments may see consolidation — fewer new large launches, less discounting, more demand.

-

The rental market may strengthen as more professionals/hybrid-workers choose Gurgaon-Delhi corridor living.

-

But expect growth rates to moderate — after rapid past jumps, future appreciation may be steadier rather than explosive.

10. Is It The Right Time to Buy?

In short: Yes, but with informed caution. Flats near Dwarka Expressway represent one of the better propositions currently in NCR — combining connectivity, choice, and growth potential. For home-buyers, it offers a lifestyle and future resale value. For investors, it gives a reasonably secure growth corridor.

But success lies in choosing the right project, sector, size, and timing. Avoid over-paying for hype, pick trusted builders, check readiness, and make sure your budget and exit horizon align with your goals.

If you buy wisely now — in 2025 — you stand to benefit from both lifestyle uplift and capital appreciation over the next 5-7 years.

Treat this not as a short-term flip, but as a medium-term strategic hold where the infrastructure will do the heavy-lifting. Whether you are seeking a comfortable flat for yourself or a shrewd investment asset, the Dwarka Expressway corridor offers a compelling platform.

📞 11. Talk to an Expert Before You Buy

If you’re a first-time homebuyer or looking to invest smartly, professional guidance can save you time and money.

👉 Contact the A2P Realtech Team — your trusted property advisors for Dwarka Expressway and Gurugram real estate.

Get expert advice on:

-

RERA-verified projects

-

Market insights & best price deals

-

Site visits and personalized assistance

🏠 Find your perfect flat on Dwarka Expressway — a smart buy that combines location, lifestyle, and long-term returns.

.jpg)