S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Top Real Estate Trends Investo...

Blogs

Top Real Estate Trends Investors Must Watch

📈 Top Real Estate Trends Investors Must Watch: Aug 2025 – Feb 2026

The Indian real estate market is entering an exciting phase marked by stability, innovation, and expanding opportunities. For investors, understanding these trends is crucial to maximizing returns and mitigating risks. Here’s a deep dive into the six key trends shaping the landscape over the next six months.

1. Stable Interest Rates Fuel Buyer Confidence

The Reserve Bank of India’s decision to hold the repo rate steady at 5.5% means home loan EMIs remain stable. This stability boosts buyer sentiment, especially in the festive season, traditionally a peak time for property purchases.

Investor Insight: Increased end-user demand leads to faster sales velocity and stronger capital appreciation, particularly in residential developments.

2. Institutional Investment Expands via REITs & InvITs

SEBI’s proposal to broaden the eligibility of strategic investors in Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InvITs) is a game changer. Including public institutions, insurance funds, and sovereign wealth funds opens the floodgates to fresh capital inflows.

Investor Insight: Enhanced liquidity, better exit options, and diversified investment avenues create a more robust real estate ecosystem.

3. Commercial Leasing Hits New Highs

India is on track to become the 4th-largest office market worldwide. Leasing demand from sectors like IT, BFSI, and flexible workspaces remains strong, driving growth in commercial real estate.

Investor Insight: High rental yields and long-term lease agreements provide steady cash flow and asset appreciation, ideal for risk-averse portfolios.

4. The Rise of Green Affordable Housing

A new $1 billion fund, led by IFC and HDFC Capital, targets green affordable housing projects across urban and Tier-2 markets. This initiative aligns with ESG goals and the growing demand for sustainable living.

Investor Insight: Investing in eco-friendly affordable housing projects can yield competitive returns while supporting sustainability and social impact.

5. Tier-2 and Tier-3 Cities Gain Momentum

As metropolitan markets mature, mid-sized cities like Jaipur, Lucknow, Indore, and Coimbatore are becoming hotspots due to infrastructure improvements and affordability.

Investor Insight: These cities offer first-mover advantages with attractive valuations and strong rental demand, perfect for both residential and commercial projects.

6. PropTech & Smart Living Become Mainstream

Technology is transforming real estate with smart homes, AI-powered analytics, virtual property tours, and blockchain for secure transactions. Buyers increasingly expect modern tech-enabled amenities.

Investor Insight: Properties integrated with PropTech attract premium tenants and buyers, enhancing asset value and reducing vacancy risks.

Latest Posts

-

-

by Admin The Survival of Affordable Hou...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

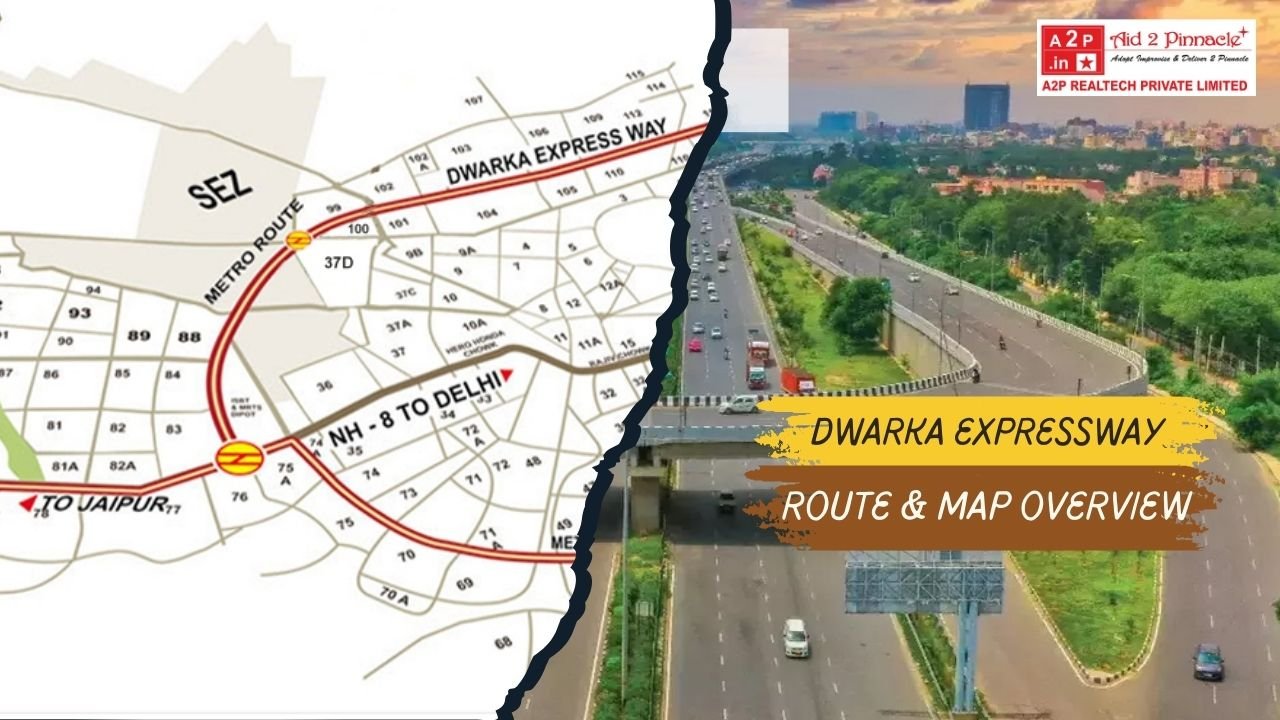

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...

.png)