S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Why Whiteland Westin Residence...

Blogs

Why Whiteland Westin Residences Sector 103 Dwarka Expressway Gurgaon Is Among the Best ROI Real Estate Investments

Why Whiteland Westin Residences Sector 103 Dwarka Expressway Gurgaon Is Among the Best ROI Real Estate Investments

Real estate investors today are increasingly looking beyond traditional locations into emerging growth corridors where infrastructure enhancements, connectivity upgrades, and higher demand translate into strong capital appreciation and rental yields. Whiteland Westin Residences in Sector 103 on the rapidly developing Dwarka Expressway in Gurugram stands out as a prime example — a luxury branded residence with the potential to deliver one of the best returns on investment (ROI) in the National Capital Region (NCR).

This property combines premium lifestyle living, strategic connectivity, brand value, amenity-rich development, and a booming micro-market, making it a top pick for both end-users and investors. Below we explore the reasons why this development is highly prized from an investment perspective.

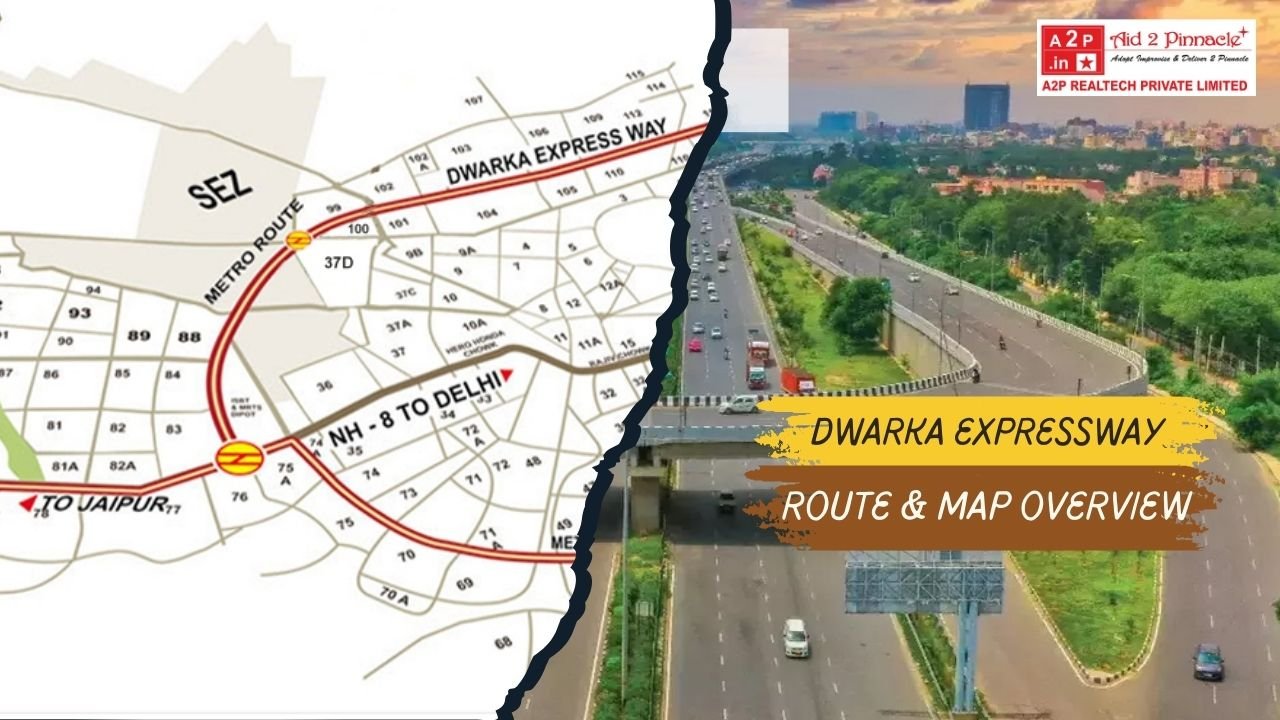

1. Strategic Location on Dwarka Expressway — The Growth Engine of Gurugram Real Estate

The location of a property is the most fundamental driver of real estate ROI. Whiteland Westin Residences occupies Sector 103 on the Dwarka Expressway — one of the fastest-growing real estate corridors in Gurugram and arguably all of NCR.

1.1 Rapid Price Appreciation Along the Expressway

-

Property values along the Dwarka Expressway have seen significant escalation, with prices nearly almost doubling over the last four years due to improved infrastructure and connectivity.

-

A recent analysis reported that Dwarka Expressway residential prices jumped from around ₹9,400/sq. ft in 2020 to nearly ₹18,600/sq. ft in 2024.

-

Average property rates on Dwarka Expressway have surged over 67 % in just two years, pointing to robust investor confidence and buyer demand.

This sustained price growth is a foundational reason why Sector 103, and Whiteland Westin Residences specifically, attracts investors seeking strong capital appreciation.

1.2 Connectivity That Drives Demand and Value

Dwarka Expressway connects Gurugram directly with key urban and business hubs:

-

Proximity to Interstate Highways: Easy access to NH-48 and regional road networks limits travel time toward Delhi and major employment centers.

-

Airport Connectivity: Short drive to Indira Gandhi International Airport (IGI) makes this location especially appealing to frequent travelers and expatriate tenants.

-

Business Hubs Access: Locality enjoys seamless commute to Cyber City, Golf Course Extension Road, Udyog Vihar and other economic zones, strengthening its residential demand profile.

Good connectivity boosts both capital value and rental potential, which is critical for ROI calculations.

2. Branded Luxury Residences: Westin Tag Adds Premium Value

One of the most compelling aspects of this development is that it’s not just another apartment project — it’s a branded residential development in collaboration with Westin (Marriott International).

2.1 The Power of Brand Association

Branded residences have become a global real estate trend where developers partner with hospitality brands (like Westin, Four Seasons, Ritz-Carlton) to offer hotel-like living experiences at home. These properties often command:

-

Higher property values than non-branded counterparts

-

Greater resale demand from premium buyers

-

Stronger tenant interest due to lifestyle prestige

The Westin brand itself represents premium lifestyle, wellness-oriented design, and global hospitality standards, and this directly enhances the perceived value and potential ROI of the asset.

2.2 Premium Amenities and Lifestyle Services

Whiteland Westin Residences offers world-class amenities — including expansive clubhouses, landscaped green spaces, concierge services, wellness facilities, and more — replicating a hospitality lifestyle at home.

Such luxury positioning typically fares well when:

-

Resale demand rises, since luxury buyers are attracted to branded products

-

Rental prospects improve, particularly among corporate tenants and NRIs

-

End-users value comfort and prestige, ensuring steady absorption

This contributing factor helps drive both short-term rental income and long-term capital gains.

3. Project Strengths That Support Higher ROI

Beyond location and brand equity, several intrinsic project qualities strengthen its investment case.

3.1 Premium Specifications and Design

Whiteland Westin Residences offers 3 BHK and 4 BHK luxury apartments with premium fixtures, modular kitchens, elegant finishes, and generous layouts — essential features that cater to upper-end buyers.

3.2 Amenities That Drive Marketability

A long list of lifestyle amenities including:

-

Large landscaped gardens and parks

-

Holistic clubhouse with sports, leisure, and community spaces

-

Jogging tracks, swimming pools, and gym facilities

-

Jogging/cycling paths and vehicle-free zones

These features make the project attractive for end-users and tenants alike.

3.3 Strong Developer and Delivery Credibility

Whiteland Corporation has tied up with reputed construction partners to ensure quality execution and timely delivery, enhancing investor confidence.

Completion reliability and quality construction help investors avoid typical market risk tied to delays — a crucial ROI consideration.

4. High Demand for Luxury Homes in Sector 103

Investors today don’t just buy homes; they buy assets with demand fundamentals.

4.1 Rising Residential Demand

Dwarka Expressway has become one of the most sought-after residential micro-markets in Gurugram, driven by solid demand from professionals and families alike.

Properties in the corridor consistently outperform many other NCR locations due to:

-

Proximity to Delhi and Gurugram employment hubs

-

Improved road accessibility

-

Rising social infrastructure like schools, hospitals, and community spaces

This increasing demand translates to stronger pricing power and resale value, a key component of ROI.

4.2 Absorption of Premium Inventory

Research shows that Dwarka Expressway has seen high absorption rates of new launches, with luxury stock being quickly booked.

High absorption indicates that this is not a speculative bubble but genuine market demand, supporting sustainable price growth.

5. Capital Appreciation Potential

While rental yield contributes income, capital appreciation is often the main driver of real estate ROI in luxury markets — and Dwarka Expressway’s growth story supports this.

5.1 Historic and Projected Price Growth

As noted:

-

Prices have nearly doubled in the last four years on the expressway.

-

Average property prices have jumped over 67 % in the last two years.

-

Infrastructure and connectivity improvements continue to catalyse demand.

Analysts further expect continued appreciation driven by office expansions, metro connectivity, and enhanced infrastructure. This sustained rise can lead to healthy long-term ROI.

6. Rental Yield and Income Potential

Luxury projects such as Whiteland Westin often command premium rentals, especially from:

-

Corporates housing expats or executives

-

Frequent travellers due to airport proximity

-

Professionals seeking quality family homes near workplaces

While gross rental yields for luxury properties typically range around 2–3 % annually, branded residences often achieve higher net returns due to their premium positioning and tenant preferences. Combining this with capital appreciation enhances total ROI.

7. Social and Economic Drivers Supporting ROI

Several broader trends strengthen ROI projections:

-

Corporate growth in Gurugram continues to attract professionals.

-

Infrastructure upgrades such as metro expansion and connectivity projects add value.

-

Urban migration trends and demand for premium housing persist, especially in Uttam Expressway and Dwarka Expressway micro-markets.

8. Summary: ROI Drivers in One Place

| Factor | Impact on ROI |

|---|---|

| Strategic location on Dwarka Expressway | High capital appreciation |

| Branded luxury (Westin/Marriott) | Premium pricing & resale demand |

| Quality construction & timely delivery | Reduced project risk |

| Connectivity to airport & business hubs | Strong rental demand |

| Rising property values | Long-term wealth creation |

| Amenities & lifestyle features | Attracts quality tenants & buyers |

Whiteland Westin Residences in Sector 103 delivers ROI through a fusion of location strength, brand value, luxury amenities, market demand, and infrastructure growth — making it a top choice for discerning real estate investors in Gurgaon.

If you’re seeking a high-potential real estate investment in the NCR, particularly in Gurugram’s emerging luxury housing segment, Whiteland Westin Residences in Sector 103, Dwarka Expressway stands out as an exceptional choice.

Its strategic positioning, premium brand association, rapid price appreciation trends, robust connectivity, and high market demand combine to deliver a strong foundation for long-term ROI. Whether you’re an investor focused on capital gains or rental income, this development offers the characteristics of a future-proof real estate asset.

Latest Posts

-

-

by Admin The Survival of Affordable Hou...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...

.png)