S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Why Gurgaon Real Estate Is Att...

Blogs

Why Gurgaon Real Estate Is Attracting Investors

Why Gurgaon Real Estate Is Attracting Investors (2026‑2030 Outlook)

Gurgaon, officially called Gurugram, has transformed itself from a peripheral suburb on the Delhi border into one of India’s most dynamic real estate investment destinations. What was once a satellite town has become a global nexus of corporate growth, infrastructure expansion, luxury living and long‑term capital opportunity.

Investors who ignored Gurugram a decade ago are now competing for every prime property, and institutional capital is entering the market like never before. But what exactly is driving this investor frenzy?

To answer that, we must look at five pillars of investment attraction:

-

Infrastructure Growth

-

Metro Expansion

-

Expressways

-

Corporate & Employment Hubs

-

Luxury Ecosystem

Let’s unpack each one with data, trends and long‑term projections.

🚧 1. Infrastructure Growth — The Foundation of Real Estate Value

Infrastructure is the baseline for property demand, value appreciation and buyer confidence. In Gurgaon, massive infrastructure initiatives have not just improved living conditions — they have rewired the city’s growth trajectory.

📍 Key Infrastructure Developments

🛣 Southern Peripheral Road (SPR)

The SPR has emerged as the region’s most active micro‑market for real estate projects. Sectors along SPR have seen significant launch activity — developers have committed ₹50,000 crore so far, with another ₹50,000 crore expected over the next few years — highlighting confidence in future growth.

🏙 Metro‑Backed Corridors

The real estate impact of metro reach is well‑known: properties within a short distance of metro stations enjoy price premiums, rental demand and faster sales velocity because buyers value accessibility.

Metro expansion in Gurugram — especially the Millennium City Centre–Cyber City Metro Line — is expected to boost residential appeal by 20–25% over the next 3–4 years as it links key residential and commercial hubs.

🏥 Social Infrastructure

Along with transit connectivity, improved schools, hospitals, parks, civic utilities and public services have raised both livability and investor interest. Proximity to high‑quality social infrastructure is a core driver of value appreciation nationwide.

📊 Infrastructure Raises Property Values — How?

Infrastructure improvements raise real estate value in multiple ways:

-

Shorter commute times

-

Stronger rental demand

-

Higher market confidence

-

Corporate relocations

-

Higher economic activity around nodes

In metro‑connected or highway‑adjacent areas, property prices often rise well above city averages — a trend playing out strongly in Gurugram.

🚆 2. Metro Expansion — Turning Commutes into Capital Appreciation

Real estate across the world follows infrastructure. In every major city — London, New York, Singapore — neighborhoods gain premier valuation tiers when rail transit arrives. Gurugram is no exception.

🚊 Metro Expansion in Gurugram

The upcoming Millennium City Centre–Cyber City Metro Line is a game‑changer. Stretching over 28.5 km with 27 stations, it aims to integrate old and new Gurugram — from Subhash Chowk and Hero Honda Chowk to Dwarka Expressway and Udyog Vihar — into a seamless mass transit spine.

This connectivity will attract:

✔ Commuters who value travel time over distance

✔ Young professionals seeking convenient transit

✔ Corporates wanting transit‑ready neighborhoods

✔ Investors targeting rental properties near transit hubs

Impact Projections:

• Metro access has historically resulted in steeper appreciation in residential properties

• Areas near metro corridors tend to record higher rental yields

• Buyers prefer locations with transit alternatives for long‑term convenience

Thus, metro expansion is not just convenience — it’s measurable real estate value creation.

🚗 3. Expressways — The Real Game‑Changers

While metro strengthens inner‑city mobility, expressways transform regional connectivity.

Gurugram has been a poster child for how highways can drive real estate growth.

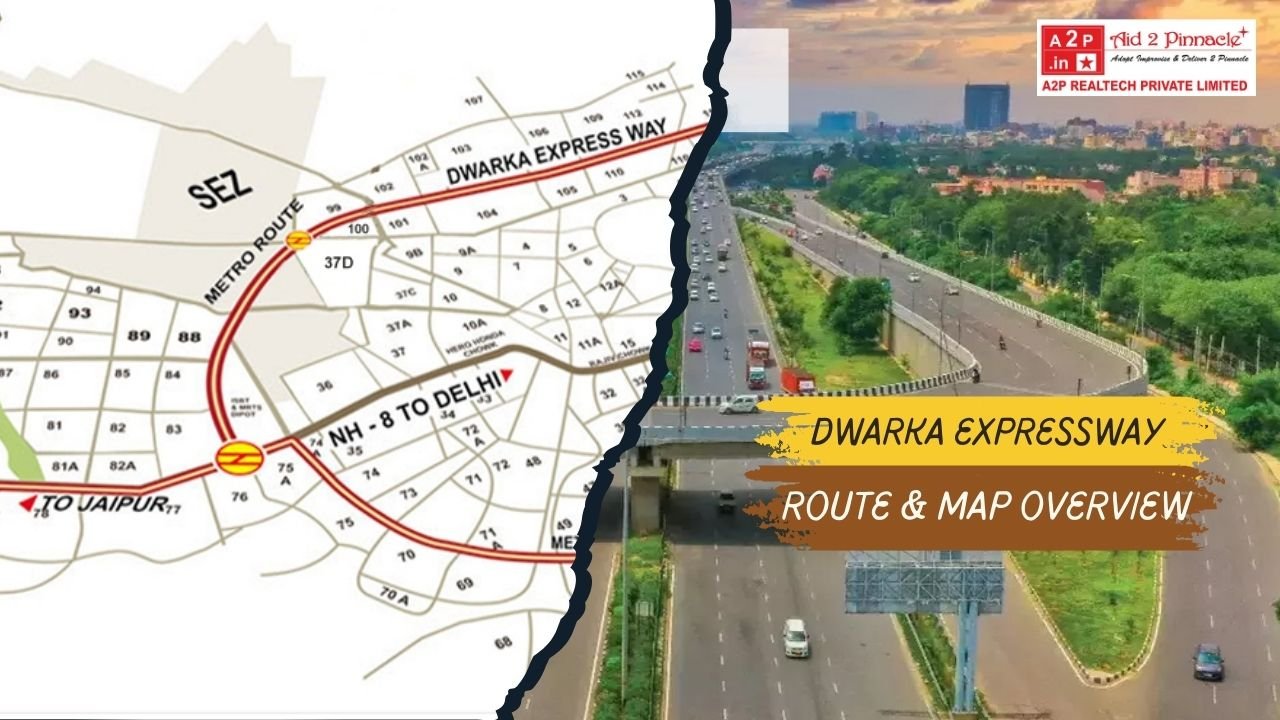

🛣 Dwarka Expressway — A Case Study

The Dwarka Expressway, stretching about 27.6 km, has reshaped how investors and developers view Gurgaon’s potential:

-

Property prices along the corridor nearly doubled in four years (from ~₹9,434/sq ft in 2020 to ~₹18,668/sq ft in 2024).

-

Analysts predict continued growth of 15–20% in the next couple of years as connectivity becomes fully functional.

-

This corridor connects directly with IGI Airport and Delhi, dramatically increasing demand for ready and under‑construction homes.

Dwarka Expressway is widely recognised as one of the fastest‑growing residential investment areas across the entire NCR, not just Gurugram.

👉 It now acts as both a commuter route and a real estate growth spine — a rare combination that attracts both homeowners and investors.

🛣 Other Expressways

✔ Southern Peripheral Road (SPR) attracts premium and mixed‑use developments.

✔ Sohna Elevated Corridor connects Gurugram to Sohna efficiently, encouraging development along this axis.

✔ NH‑48 & Outer Ring Road links provide access to other major NCR nodes, making Gurugram accessible and connected.

This web of expressways creates multiple investment corridors — not just locations — contributing to diversified investor interest.

🏢 4. Corporate Hubs — Jobs Drive Real Estate Demand

Real estate doesn’t grow alone — it grows with jobs, incomes and corporate growth.

Gurugram has built itself into one of India’s top corporate and employment hubs, with more than 500 multinational and IT firms located here.

🤝 Why Corporate Growth Matters

Corporate and job growth impacts real estate in several direct ways:

📈 1. Rising Demand for Housing

A steady stream of professionals — from mid‑level managers to senior executives — creates a constant base of end‑users, renters, and movers.

📊 2. Rising Rental Demand

Young professionals and corporate employees often choose rental living first, driving:

✔ Strong rental yields

✔ Low vacancy rates

✔ Stable cash flows

🏢 3. Commercial Real Estate Growth

Gurugram isn’t just residential — its office space dynamics further attract investors in commercial property, retail spaces and mixed‑use developments.

🏙️ 4. Anchor Business Hubs

📍 Cyber City

One of India’s leading corporate campuses, Cyber City hosts technology majors, global consultancies and Fortune 500 firms — creating daily footfall and economic activity that spills over into real estate demand.

📍 Udyog Vihar & Other Industrial Estates

These large employment clusters add to the workforce population that needs nearby homes and services.

The combination of jobs + transit + expressway connectivity has made Gurgaon unique among NCR cities: it’s not a dormitory town — it’s an economic magnet.

🏙️ 5. Luxury Ecosystem — The New Face of Real Estate Value

Luxury real estate in Gurgaon is not about isolated mansions. It’s about curated lifestyles, branded residences, world‑class amenities, and aspirational living spaces. This attracts a specific breed of investor: local HNIs, NRIs, family offices and high‑net‑worth individuals seeking both lifestyle and returns.

💎 Luxury Market Growth Indicators

In 2024, Gurugram recorded a record ₹88,144 crore realty investment, the highest since HRERA’s establishment.

Developers and analysts noted a distinct shift toward luxury properties, supported by:

✔ High‑end amenities

✔ Global standards in construction

✔ Branded projects

✔ Integrated townships

Market commentary has observed a 55% year‑on‑year surge in under‑construction luxury property values in 2024 — a clear signal that demand is not just stable, but accelerating.

📍 Emerging Luxury Corridors

Today’s luxury growth is decentralized — not restricted to traditional Golf Course Road — and is spreading to:

✔ Dwarka Expressway

✔ Southern Peripheral Road (SPR)

✔ Golf Course Extension Road

✔ Sohna Road

These corridors offer modern, broader infrastructure, club‑grade amenities, expansive layouts and branded residences — something modern HNIs highly value.

🏘 Market Value Indicators

According to recent real estate data:

• Property prices on Dwarka Expressway showed dramatic appreciation, and absorption rates remain high.

• Sectors near corporate hubs and transit lines command premium rates compared to peripheral or under‑connected areas.

Luxury demand is so concentrated that in H1 2025, Gurgaon accounted for around 91% of the luxury housing absorption in NCR, illustrating its dominant position.

📊 6. Price Growth & Return Trends — Data Insights

📈 Dwarka Expressway Appreciation

Property prices have nearly doubled over four years from 2020 to 2024, with projections suggesting further growth of 15–20% in the next few years.

📊 Sector‑Wise Growth Potential

Analysts project corridors like Sohna and SPR to register the sharpest price growth, up to 1.6× by 2030, backed by sustained infrastructure and demand momentum.

🔁 Luxury & Premium Segment Growth

With strong capital flows — over ₹88k crore invested in 2024 alone — premium segments are outperforming in terms of investor interest and price resilience.

This data supports the narrative that Gurgaon real estate is not a speculative bubble, but a structurally driven market with long‑term appreciation potential.

🧠 7. Investor Psychology — Confidence and Predictability

Investors seek certainty and value preservation. Gurgaon’s real estate market has steadily improved in:

✔ Regulatory transparency (RERA compliance boosts confidence)

✔ Developer project delivery track record

✔ Economic & job growth momentum

✔ Infrastructure planning & completion timelines

This sense of reliability — not just hype — is what attracts serious capital from investors who might otherwise choose established global cities.

🏆 Case Highlight: Dwarka Expressway & A2P Realtech

One of the hottest investment zones in Gurugram today is Dwarka Expressway — a corridor that offers the rare combination of connectivity, airport access, luxury development and future capital appreciation.

As this corridor matures, it has drawn attention not just from homebuyers but institutional and private investors alike. 💡

And for those looking to buy, invest or diversify their portfolio here, an important name to note is:

🌟 A2P Realtech — Sales Channel Partner for Dwarka Expressway

A2P Realtech serves as a trusted sales channel partner for luxury and premium projects along the Dwarka Expressway, providing:

✔ Access to exclusive listings

✔ Early‑bird pricing and priority units

✔ Market insights and investment strategy

✔ Transparency and negotiation expertise

With the Corridor now maturing, A2P Realtech’s presence on Dwarka Expressway positions investors to tap into the growth trajectory before saturation — a key edge for long‑term value creation.

📌 Summary: Why Gurgaon Is a Real Estate Magnet

Let’s recap the main drivers attracting investors:

✔ Infrastructure Growth

Major roads and urban planning are expanding the city’s footprint, raising property values.

✔ Metro Expansion

Transit connectivity increases livability and price premiums near stations.

✔ Expressway Network

Dwarka Expressway, SPR and Sohna corridors have catalyzed appreciation.

✔ Corporate Hubs

Gurgaon’s economic base creates sustained housing demand.

✔ Luxury Ecosystem

Premium living options with luxury amenities attract HNIs and global buyers.

✔ Price Growth Trends

Corridors showing double‑digit annual price growth — a strong ROI signal.

🧠 Final Takeaway for Investors

Gurgaon’s real estate story is not about transient price spikes — it’s about structural growth backed by infrastructure, corporate demand and lifestyle evolution. This combination makes it one of India’s most compelling long‑term investment landscapes.

For investors seeking diversification, rental yields, or legacy capital assets — Gurgaon, especially key corridors like Dwarka Expressway (with partners like A2P Realtech), continues to offer unmatched opportunity.

Latest Posts

-

-

by Admin Exploring the Most Exciting Ne...

-

by Admin Sobha 63A Golf Course Gurgaon ...

-

by Admin The Survival of Affordable Hou...

-

by Admin Gurgaon to Delhi Airport dista...

-

by Admin Why Gurgaon Is the Future of L...

-

by Admin Is Gurgaon a Good Place to Inv...

-

by Admin How to Buy Property in Gurgaon...

-

by Admin Gurgaon Luxury Real Estate Gui...

-

by Admin Why A2P Realtech Is the Best C...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Best Real Estate Company in Gu...

-

by Admin Is Gurgaon property safe under...

-

by Admin How to Choose the Right Real E...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin Why Gurgaon Real Estate Is Att...

-

by Admin Why Local Expertise Matters in...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Is Gurgaon better than South D...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin How close is Gurgaon to Delhi ...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Why Invest in Smartworld GIC G...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Is buying property in Gurgaon ...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...