S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Is buying property in Gurgaon ...

Blogs

Is buying property in Gurgaon safe under RERA

Yes — buying property in Gurgaon (also spelled Gurugram) is generally safer under the Real Estate (Regulation and Development) Act, 2016 (RERA) framework, especially if you follow due diligence and understand the updated rules and safeguards. RERA has transformed how property transactions are regulated in India and in Haryana, significantly strengthening protections for homebuyers, enforcing transparency, and holding builders and agents accountable. But safety isn’t automatic — it depends on careful compliance with the law, proper verification of registrations, and awareness of regulatory updates. Below is a deep-dive guide suitable for real estate blogs and long-form articles, explaining how RERA works in Gurgaon, its updated rules, benefits, limitations, practical steps, risks to watch, and tips for safe investing.

📌 1. What Is RERA (Real Estate Regulatory Authority)?

The RERA Act, 2016 is a central law enacted by the Parliament of India to regulate and promote the real estate industry, protect homebuyers’ interests, and bring transparency and accountability to property transactions. It came into force on 1st May 2016 with various provisions notified in phases, and the remaining sections implemented in 2017.

Under this Act, each state is required to establish a Real Estate Regulatory Authority (RERA), which registers real estate projects and agents, monitors compliance with the law, and resolves disputes between buyers and developers.

In Haryana, there are two RERA authorities:

-

HRERA Gurugram

-

HRERA Panchkula

Both have jurisdiction over real estate projects in their respective regions.

📌 2. Why RERA Matters for Property Buyers in Gurgaon

🏠 2.1. Mandatory Project Registration

Under RERA, every real estate project (residential or commercial) that exceeds 500 square meters or has more than eight units MUST be registered with the state RERA authority (HRERA) before it can be marketed, advertised, or sold.

What this means:

-

Promoters cannot legally sell properties in an unregistered project.

-

You can verify the registration status online on the official Haryana RERA portal. If a project is not registered, any agreements or booking amounts given to the builder may not be enforceable.

This alone dramatically reduces the risk of investing in illegal or non-compliant developments.

🏢 2.2. Mandatory Agent Registration

RERA also requires all real estate agents, brokers, intermediaries, and channel partners to obtain official registration with HRERA before they can legally facilitate property transactions.

Regulatory advisories now explicitly warn buyers to deal only with registered agents, because:

-

Unregistered agents are not accountable under RERA.

-

Such agents often offer misleading assurances, lack legal backing, and can expose buyers to financial loss or invalid agreements.

Advice: Always verify an agent’s RERA registration on the HRERA portal before engaging him/her for any property transaction.

📊 2.3. Full Disclosure of Project Information

RERA mandates that developers must disclose comprehensive project information — including:

-

approved layout plans,

-

land title approvals,

-

financial plans,

-

clearance and permit statuses,

-

completion timelines,

-

and other vital facts — on the state RERA portal before any sale.

This public repository of data helps buyers:

-

make informed decisions,

-

compare projects transparently,

-

and avoid deals based on half-truths or marketing hype.

💰 2.4. Escrow Account for Buyer Funds

One of the most important safeguards is the escrow account rule:

Developers must deposit at least 70% of the money collected from buyers into a dedicated escrow account, which can only be used for construction costs and land development for that specific project.

Why this matters:

-

This prevents diversion of funds to other projects or unrelated expenses — a major cause of stalled projects in the pre-RERA era.

-

It ensures that work on the specific project progresses instead of developers using the funds as working capital elsewhere.

📅 2.5. Timely Possession & Compensation

RERA obligates developers to deliver possession within the timeline declared at the time of project registration.

If they fail to do so, the law allows homebuyers to:

-

withdraw from the project and receive a refund with interest, or

-

insist on completion with delayed possession compensation.

This provision has real teeth because developers face:

-

financial penalties, and

-

legal obligations to provide interest on delayed possession.

🏗 2.6. Standardised Sale Agreements & Pricing

RERA requires that sale agreements follow a standard format and that pricing be based on carpet area — the actual usable area — rather than the larger and often misleading super built-up area.

This prevents builders from adding hidden charges or misrepresenting what buyers will actually receive.

🛠 2.7. Defect Liability Period

Under RERA, builders are legally responsible for correcting any structural or workmanship defects for up to five years after possession.

This gives buyers peace of mind and protects them from immediate out-of-pocket expenses right after moving in.

📜 2.8. Fast-Track Grievance Redressal

RERA authorities, including HRERA Gurugram, offer a specialised, time-bound grievance redressal mechanism for complaints against developers.

As part of recent regulatory strengthening in Gurugram:

-

HRERA has expanded its bench members and quorum, aiming to speed up hearing and resolution of buyer complaints.

This means disputes involving delays, misrepresentation, or defaults can potentially be resolved faster and effectively.

📌 3. Updated Rules and Recent Regulatory Trends

Over the past year, HRERA and the Haryana government have introduced or reinforced key regulatory practices aimed at increasing buyer safety and discouraging fraud.

🛑 3.1. Registered Agents Only

HRERA has explicitly advised buyers to deal only with agents registered under RERA, warning that unregistered brokers can cause legal problems, financial losses, and invalid agreements.

This advisory reinforces the need for buyers to avoid unofficial intermediaries.

📢 3.2. Public Notice Before Registration

To curb aggressive pre-launch marketing (selling units before formal RERA registration), authorities now require developers to issue a public notice when they apply for registration. This gives buyers a chance to verify status and avoid premature investments.

💼 3.3. Penalties and Enforcement

HRERA actively penalises developers and agents for non-compliance, including:

-

forfeiting security deposits,

-

monetary fines,

-

and in some cases revoking project registrations.

Additionally, regulators have issued show-cause notices to agents for unfair practices, underscoring that RERA norms apply to intermediaries as well.

Recent news from the broader RERA landscape highlights how regulatory bodies are taking enforcement seriously: in some states, authorities have imposed penalties for illegal allotments or developer misconduct, showing that RERA remains an active regulatory force nationwide.

📌 4. Risks and Limitations to Be Aware Of

⚠️ 4.1. Regulatory Gaps and Implementation Issues

While the RERA framework is strong on paper, some implementation challenges exist, such as delays in enforcement or gaps in data publication by certain authorities. A recent report highlighted that many state RERA bodies have not fully published required annual reports, undermining transparency.

This suggests that while RERA adds safeguards, buyers must still be vigilant.

⚠️ 4.2. Unauthorized Developments in Surrounding Areas

In rapidly expanding markets like Gurgaon’s periphery, enforcement against illegal colonies and unauthorized constructions continues outside the RERA domain, often spearheaded by urban planning departments. News reports show demolitions and enforcement actions against such illegal plots, reminding buyers to verify project approvals beyond just RERA registration.

⚠️ 4.3. Buyer Responsibility

RERA enhances protection, but buyer due diligence remains essential:

-

always verify RERA project registration,

-

check agent credentials,

-

confirm land titles and municipal approvals,

-

and read all agreements thoroughly before signing.

RERA helps reduce risk, but it does not eliminate the need for informed investment decisions.

📌 5. Practical Guide: Steps to Buy Safely in Gurgaon Under RERA

Here’s a step-by-step checklist you can include in your blog or buyer guide:

⭐ Step 1 — Verify RERA Registration

Check the project’s registration status on the official Haryana RERA portal before booking.

🧑💼 Step 2 — Check Agent Credentials

Confirm that the real estate agent or broker is registered with HRERA. This is now a regulatory requirement not just a best practice.

📄 Step 3 — Review Sale Agreement

Ensure the agreement follows the RERA standardised format and that advance payments don’t exceed the 10% cap before signing.

📊 Step 4 — Confirm Escrow Compliance

Ask for proof that your payments will (or are) deposited into the 70% escrow account, protecting your funds.

🏗 Step 5 — Track Project Progress Online

Use the RERA portal to check quarterly construction updates and timelines.

⚖️ Step 6 — Understand Grievance & Compensation Rights

Know how to file a complaint with HRERA if timelines slip or misconduct occurs.

🏢 Step 7 — Conduct Independent Title & Land Approval Checks

Do not rely solely on RERA registration — also verify municipal approvals, zoning acceptance, and land clearances.

📌 6. Is Buying Property in Gurgaon Safe Under RERA?

In general, yes — buying property in Gurgaon under RERA is much safer now than it was pre-RERA, especially when:

✅ Projects are RERA-registered

✅ Agents are HRERA-registered

✅ Buyers follow a thorough due diligence process

✅ Agreements are compliant with legal standards

✅ Payments are managed wisely

RERA has introduced unprecedented transparency, accountability, and legal protection, empowering buyers in ways unheard of in the pre-2017 market.

However, RERA is not a silver bullet — it is a regulatory framework that reduces but does not eliminate all risks. Buyers must combine RERA safeguards with careful verification of land titles, approvals, and financial commitments.

When you combine RERA’s protective architecture with informed buyer behavior, purchasing property in Gurgaon becomes a much more secure and structured experience than before — and a topic worthy of detailed coverage in your real estate blog.

Latest Posts

-

-

by Admin Exploring the Most Exciting Ne...

-

by Admin Sobha 63A Golf Course Gurgaon ...

-

by Admin The Survival of Affordable Hou...

-

by Admin Gurgaon to Delhi Airport dista...

-

by Admin Why Gurgaon Is the Future of L...

-

by Admin Is Gurgaon a Good Place to Inv...

-

by Admin How to Buy Property in Gurgaon...

-

by Admin Gurgaon Luxury Real Estate Gui...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Is Gurgaon property safe under...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin How close is Gurgaon to Delhi ...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

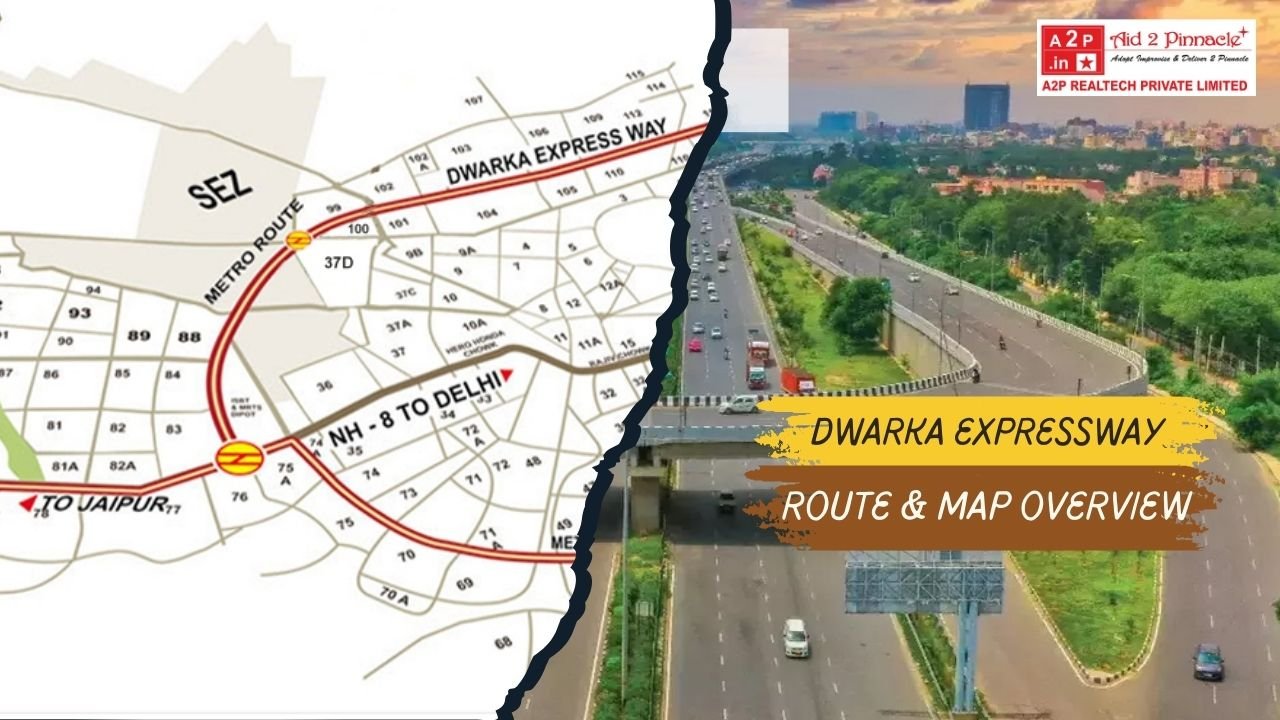

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Why Invest in Smartworld GIC G...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Is buying property in Gurgaon ...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...