Key Features of Sobha City Sector 108, Dwarka Expressway, Gurgaon

Sobha City Sector 108 is a premium residential township that redefines luxury living in Gurgaon. Spread across 39 acres of land, it combines architectural excellence, resort-style amenities, and a lush green environment to deliver a modern urban lifestyle. Developed by Sobha Limited, one of India’s most trusted and reputed real estate developers, this project offers exceptional quality, design, and long-term value.

Project Overview

-

Developer: Sobha Limited

-

Location: Sector 108, Dwarka Expressway, Gurgaon

-

Project Type: Luxury high-rise residential apartments

-

Area: ~39 acres

-

Apartment Types: 2 BHK, 3 BHK, 4 BHK

-

Size Range: 1,381 sq. ft. to 2,343 sq. ft.

-

RERA Number: Registered under RERA (for different phases)

Key Features & Highlights

| Feature | Description |

|---|---|

| Massive Green Cover | Over 8.5 acres of open green space, parks, and landscaping – among the largest in Gurgaon |

| Resort-Style Living | Includes a man-made lakelet, open-air café, and a temperature-controlled swimming pool |

| Sports Facilities | Full-size cricket ground, tennis courts, volleyball courts, and indoor sports areas |

| Clubhouses | Two large, fully equipped clubhouses with gyms, spa, yoga studio, multipurpose halls, and more |

| Walking/Cycling Trails | Dedicated tracks for walking, jogging, and cycling amidst landscaped gardens |

| 24x7 Security | Gated community with advanced CCTV surveillance and multi-tier security |

| Construction Quality | Sobha’s trademark in-house construction ensures superior finishing and long-term durability |

| High-Speed Elevators | Premium elevators for smooth and fast access to all residential floors |

| Rainwater Harvesting & Sustainability | Eco-conscious infrastructure for sustainable urban living |

| Proximity | Located just 15 minutes from IGI Airport, and easily accessible to Cyber City, Dwarka & Delhi |

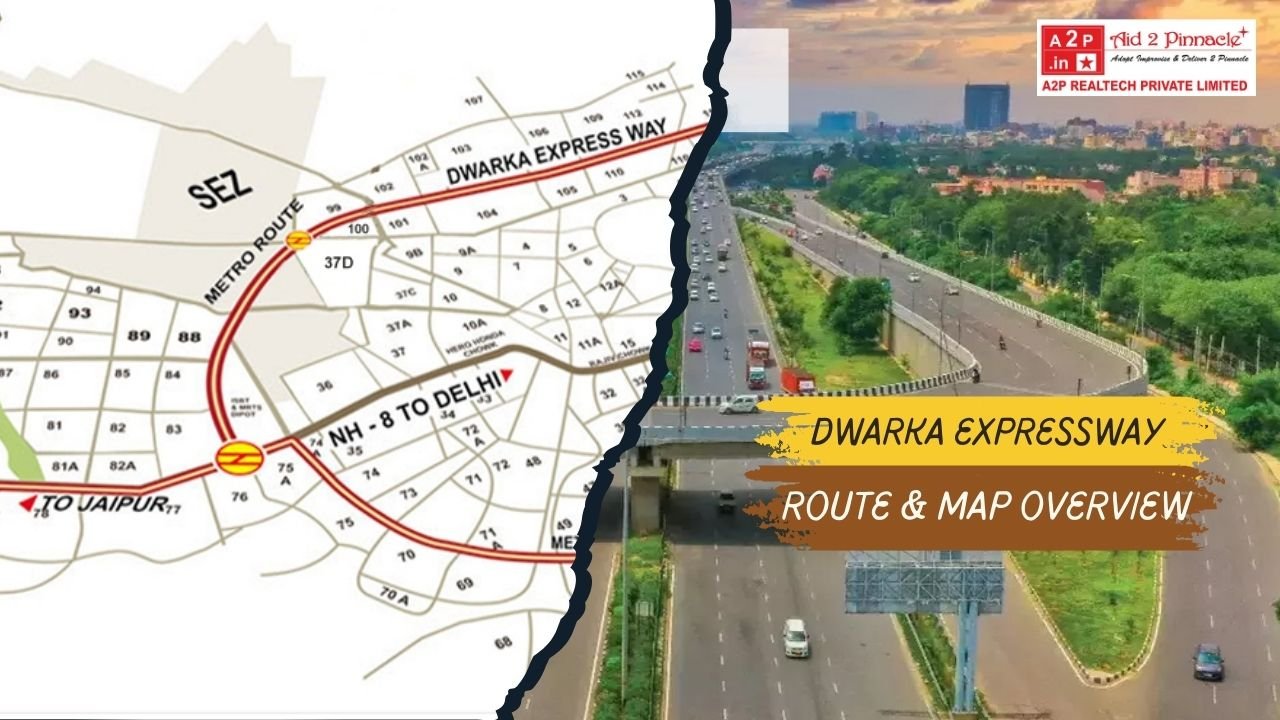

Connectivity & Location Advantage

-

Strategically placed on Dwarka Expressway, a fast-emerging growth corridor

-

Adjacent to Delhi, yet nestled in the peaceful, green belt of Sector 108

-

Close to proposed metro station, schools, hospitals, and commercial hubs

Possession Timeline

-

Phased development; some towers already delivered or nearing completion

-

Remaining units expected to be completed by 2027–2028, depending on phase

Why It Stands Out

-

One of the largest luxury gated communities in the area

-

Trusted brand with consistent on-time delivery record

-

Strong potential for capital appreciation and lifestyle upliftment

If you're seeking a premium residence with long-term ROI and exceptional amenities, Sobha City Sector 108 is a standout choice on the Dwarka Expressway corridor.

Price Trends on Dwarka Expressway

-

2020–2024: Average property rates nearly doubled, climbing from about ₹9,434/sq ft in 2020 to ₹18,668/sq ft in 2024

-

Annual growth in 2024: Property prices surged ~29% in 2024 alone

-

Long-term surge: Over the last 14 years, housing prices have risen ~5×, from around ₹3,500–4,500/sq ft in the early 2010s to ₹18,000+/sq ft today

Sector 108 Specific Insights

-

Current average rate: Approximately ₹16,138/sq ft as per Q2 2025 market data

-

Growth rates: Around 29% YoY growth in 2024 . Over the past three years, appreciation is nearly 88% .

-

Quarterly trend: After a modest dip of –1% QoQ in Q2 2025, prices still remain elevated

Key Growth Drivers

-

Infrastructure rollout: Completion of the full 27.6 km, 16‑lane expressway (operational since June 2025), along with flyovers and cloverleaf interchanges, significantly improved connectivity

-

Metro and transit expansion: Upcoming metro corridors linking Dwarka and Gurugram (2027+) are expected to further enhance value.

-

Major real estate launches: Prominent developers (Sobha, M3M, Signature, etc.) are concentrating on premium developments here

-

End-user preference: Growing demand from families and professionals seeking better quality living near Delhi and airport

Future Outlook & Forecast

-

5-year forecast: Experts estimate 40–60% appreciation from current levels (to 2030)

-

Short term projection: Another 15–20% rise by 2026, driven by expressway and metro completions

-

High absorption rate: Over 67% YoY growth in sales volumes (12,409 units sold in 2023), reflecting strong demand

Interpretation for Investors

-

Sector 108 is attracting premium growth: Robust 30% YoY gains with solid 3‑year appreciation (~88%).

-

Future gains remain attractive: With base prices of ₹16k/sq ft, an additional 40–60% upside could push values toward ₹22–26k/sq ft by 2030.

-

Metro corridor advantage: The upcoming metro link (by 2027) may act as a catalyst for renewed demand and premium pricing in sectors close to stations.

-

Timing matters: With substantial index jumps since 2020, 2025 still offers entry at strong momentum levels—but margins may narrow as infrastructure stabilizes.

Summary Table

| Time Period | Price per sq ft | Growth (%) |

|---|---|---|

| 2010 → 2024 | ₹3,500–₹18,000+ | 400% |

| 2020 → 2024 | ₹9,434 → ₹18,668 | 98% |

| Sector 108 Y-o-Y 2024 | — | 29% |

| Sector 108 3‑yr | — | 88% |

| 2025–2030 projection | ₹16k → ₹22–26k | 40–60% |

Amenities and Lifestyle Offerings in Sobha City Sector 108, Dwarka Expressway

Sobha City Sector 108 isn’t just a residential project—it’s a fully integrated lifestyle ecosystem. Designed to offer resort-style living within a secure, urban setting, the township is packed with modern amenities, green landscapes, and wellness-focused infrastructure. The aim: to provide a premium experience for families, working professionals, and long-term investors seeking both comfort and class.

Sports & Recreation Amenities

| Amenity | Details |

|---|---|

| Cricket Ground | Full-size, professional-grade cricket field—rare in residential projects. |

| Tennis & Volleyball Courts | Multiple outdoor courts for active, community-friendly recreation. |

| Indoor Games Arena | Spaces for badminton, table tennis, snooker, and more. |

| Swimming Pools | Two temperature-controlled pools, including a 25-meter lap pool and a leisure pool. |

| Jogging & Cycling Track | 1.25 km looped track set amidst lush greenery for safe and scenic fitness routines. |

Green & Open Spaces

-

8.5+ Acres of Landscaped Greens – Among the largest open areas in Gurgaon residential projects.

-

Man-made Lakelet – A beautiful water body with a leisure deck, enhancing both aesthetics and microclimate.

-

Reflexology Paths & Meditation Zones – Quiet spaces designed for mental wellness and nature interaction.

-

Dedicated Pet Area – Pet-friendly features including open parks and walking zones.

Clubhouses & Wellness Facilities

| Feature | Description |

|---|---|

| 2 Clubhouses | Combined area over 40,000+ sq. ft., featuring lounges, libraries, business centers. |

| Spa & Sauna | Luxury spa services with sauna/steam rooms for complete rejuvenation. |

| Yoga & Fitness Studios | Specialized spaces for yoga, pilates, Zumba, and dance. |

| Fully-Equipped Gym | High-end cardio and strength training equipment in air-conditioned space. |

Family-Oriented Amenities

-

Children’s Play Areas – Multiple parks with safe and modern equipment

-

Skating Rink & Amphitheatre – Active and cultural engagement options for kids and adults

-

Mini-Mart & Pharmacy – Daily convenience without leaving the complex

-

Reading Lounges & Café Spaces – Relaxing zones for community engagement

Security & Comfort Features

-

Multi-Tier Security – 24x7 surveillance with manned gates, RFID access, CCTV cameras

-

Fire Safety & Emergency Response – Adherence to all fire norms and emergency plans

-

High-Speed Elevators – Silent, energy-efficient lifts in all towers

-

Power Backup – 100% backup for common areas and essential home utilities

Parking & Access

-

Dedicated Covered Parking – Ample basement parking for residents and visitors

-

EV Charging Points – Ready infrastructure for electric vehicles

-

Drop-Off Zones – Smartly designed vehicular movement with dedicated pickup/drop points

The Lifestyle Advantage

-

Luxury meets functionality: The project combines resort-style living with urban efficiency.

-

Community-centric design: Multiple gathering zones promote resident interaction.

-

Balanced for all ages: Amenities suit young professionals, families, children, and the elderly alike.

-

Brand Reliability: Sobha’s in-house construction ensures top-notch quality and long-lasting finish.

The Impact of Infrastructure Development on ROI

Sobha City Sector 108, Dwarka Expressway, Gurgaon

Infrastructure development is one of the most critical drivers of real estate appreciation and Return on Investment (ROI). In the case of Sobha City, Sector 108, the massive transformation of the Dwarka Expressway corridor and surrounding civic infrastructure is significantly boosting property value and long-term investment returns.

Key Infrastructure Developments Fueling ROI Growth

1. Dwarka Expressway (Northern Peripheral Road)

-

Now fully operational (as of mid-2025), this 16-lane expressway drastically reduces travel time between Delhi and Gurugram.

-

Enhances connectivity to IGI Airport (15 minutes), Cyber City, and Dwarka Sector 21 Metro Station.

-

Effect on ROI: Property values along the expressway have nearly doubled from 2020 to 2024, with projected gains of another 40–60% by 2030.

2. Proposed Metro Corridors

-

The upcoming Dwarka Sector 21–Gurgaon metro link will pass close to Sector 108.

-

Metro access is a major ROI booster due to convenience for daily commuters and tenants.

-

Expected timeline: By 2027

-

Effect on ROI: Typically, properties near metro stations appreciate 10–25% more than those farther away.

3. Urban Civic Infrastructure

-

Widened internal roads, stormwater drainage, LED street lighting, underground wiring, and green zones are being developed across Sectors 102–113.

-

Enhances overall liveability and resale appeal.

-

Effect on ROI: High livability scores directly correlate with faster absorption and higher pricing power.

4. Commercial & Social Infrastructure

-

Major retail hubs, schools (Delhi Public School, Euro International), hospitals (Medeor, Artemis Lite), and entertainment zones are coming up within 10–15 minutes of Sobha City.

-

The development of commercial zones nearby will bring in a wave of employment and service sector demand.

-

Effect on ROI: Drives rental demand and resale interest, especially from working professionals and corporate tenants.

5. IGI Airport Proximity

-

Direct access to Terminal 3 of IGI Airport via expressway ensures massive time savings.

-

Ideal for NRIs, pilots, and frequent flyers—enhancing rental demand and resale potential.

Real-World ROI Trends from Infrastructure Impact

| Factor | ROI Influence | Sobha City Impact |

|---|---|---|

| Expressway Completion | +30–50% capital appreciation | Already seen major post-announcement surge |

| Metro Connectivity | +10–25% price jump | Expected after corridor announcement |

| Social Infra Growth | Increased rental yield and long-term value | Strong appeal to families and professionals |

| Airport Connectivity | Niche buyer segment, better resale | Major selling point for high-end investors |

Tips for Investors Looking at Sobha City Sector 108, Dwarka Expressway

Investing in a premium project like Sobha City Sector 108 offers excellent ROI potential, but making informed decisions can maximize your gains and minimize risks. Here are some practical tips to guide you:

1. Research the Developer’s Track Record

-

Sobha Limited is renowned for quality construction and timely delivery—verify past project timelines and customer reviews.

-

A trustworthy developer ensures fewer legal or construction delays, safeguarding your investment.

2. Focus on Ready-to-Move or Near-Completion Units

-

Ready possession or nearly completed phases typically offer quicker returns through rentals or resale.

-

Under-construction units may offer attractive prices but come with delivery risk and longer capital lock-in.

3. Choose the Right Apartment Size and Layout

-

2 and 3 BHK units generally have higher demand among end-users and renters.

-

Larger units (4 BHK) can fetch premium prices but may have a narrower buyer pool.

-

Analyze local rental trends to match demand with your investment goals.

4. Leverage Location within the Project

-

Apartments overlooking green spaces, water bodies, or clubhouses tend to appreciate faster.

-

Lower floors might be easier to rent; higher floors often command premium prices.

-

Corner and well-ventilated units are preferred for resale value.

5. Monitor Infrastructure Updates

-

Track progress on Dwarka Expressway flyovers, metro lines, and nearby civic projects.

-

Infrastructure completion typically triggers price jumps—consider timing your purchase accordingly.

6. Understand Payment Plans & Financing

-

Opt for payment plans that align with your cash flow and investment horizon.

-

Explore home loan options—low-interest rates improve overall ROI.

-

Check for any ongoing discounts, offers, or stamp duty benefits.

7. Evaluate Rental Yield Potential

-

Research rental rates in Sector 108 and neighboring areas.

-

Properties near business hubs and transit points typically yield higher rent.

-

Calculate your expected rental yield alongside capital appreciation for a full ROI picture.

8. Check Legal Clearances and RERA Registration

-

Ensure the property is RERA registered with clear titles.

-

Review documentation to avoid legal hassles later.

9. Consider Long-Term Appreciation

-

Dwarka Expressway is a rapidly developing corridor; patience often rewards investors with strong capital gains.

-

Short-term flips may be possible but carry more risk due to market fluctuations.

10. Stay Updated on Market Trends

-

Follow real estate news and consult with local agents.

-

Market dynamics can shift quickly; being informed helps you make timely decisions.

Making Informed Investment Decisions for Sobha City Sector 108

Investing in real estate is a significant financial commitment, and making well-informed decisions can be the difference between strong returns and missed opportunities. When considering Sobha City Sector 108 on Dwarka Expressway, here are some key factors and strategies to help you invest wisely:

1. Understand the Market Dynamics

-

Study the current and historical property price trends in Sector 108 and the wider Dwarka Expressway corridor.

-

Keep an eye on demand-supply metrics, absorption rates, and future development plans that influence property values.

-

Consider macroeconomic factors such as interest rates, government policies, and urban growth projections.

2. Analyze the Location’s Potential

-

Evaluate the proximity to key infrastructure like the expressway, metro stations, schools, hospitals, and commercial hubs.

-

Assess upcoming infrastructure projects and their timelines, as these often precede price appreciation.

-

Investigate neighborhood development plans and civic amenities that contribute to livability and desirability.

3. Inspect the Developer Credentials

-

Verify Sobha Limited’s reputation for timely delivery, construction quality, and after-sales service.

-

Review previous projects and customer feedback.

-

Check the developer’s financial stability and ongoing project pipeline.

4. Assess the Property Features

-

Look for layouts and unit sizes that are in high demand (usually 2 and 3 BHK apartments).

-

Prefer apartments with views of open green spaces, water bodies, or amenities to enhance future resale value.

-

Consider the floor level, orientation, ventilation, and natural lighting.

5. Evaluate Financial Implications

-

Calculate the total cost including booking amount, registration fees, maintenance charges, and taxes.

-

Understand available payment plans and financing options.

-

Factor in expected rental yields, maintenance costs, and potential capital appreciation.

-

Use tools like ROI calculators and scenario analyses to project returns over 3, 5, and 7 years.

6. Verify Legal and Regulatory Compliance

-

Ensure the project has all necessary approvals and is registered under RERA.

-

Review title documents, ownership history, and building permits.

-

Consult legal experts if needed to avoid future disputes.

7. Plan for the Long Term

-

Real estate investments typically yield better returns over a medium to long-term horizon (5+ years).

-

Be prepared for market fluctuations and hold onto the asset through growth phases.

-

Consider the benefits of phased investment or diversification within the project.

8. Engage with Professionals

-

Seek advice from real estate consultants, financial advisors, and legal experts.

-

Attend site visits, open houses, and developer presentations to gather firsthand information.

-

Network with existing residents or investors to understand community experience.

.jpg)