S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Westin Residency ROI Breakdown...

Blogs

Westin Residency ROI Breakdown Gurgaon Dwarka Expressway Property Gains

Whiteland Westin Residency ROI Breakdown: Sector 103 Gurgaon, Dwarka Expressway Property Gains

Investing in real estate is all about location, returns, growth potential, and future demand — and when it comes to premium residential investments in the National Capital Region (NCR), few corridors combine all these factors like the Dwarka Expressway in Gurgaon. At the heart of this fast-appreciating real estate belt is The Westin Residences in Sector 103, Gurgaon — a branded luxury residential project that’s attracting savvy investors and high-net-worth individuals alike.

In this detailed guide, we’ll unpack the Return on Investment (ROI) prospects of Westin Residency, the growth drivers of Sector 103 and the Dwarka Expressway, plus all the other investment factors you should know before making a decision.

What Makes Whiteland Westin Residences Sector 103 a Premium Investment?

1. Branded Residence by Westin Hotels & Resorts

One of the biggest investment attractions of this project is its brand association with Westin — a globally recognised luxury hospitality brand under Marriott International. This elevates the property’s appeal among luxury homebuyers and high-end tenants, making it stand out compared to generic residential projects in the area.

Floor Plan Highlights & Configuration Details of Whiteland Westin Residency

2. Luxury Amenities and Premium Lifestyle

Westin Residences is designed as a wellness-centric, high-standard lifestyle address, offering:

-

Expansive clubhouse (~2 lakh sq. ft.)

-

Spa, fitness and wellness facilities

-

Concierge services inspired by 5-star hotel living

-

Landscaped gardens, sports facilities, lounges and more

All of these enrich the resident experience and help in commanding higher rental rates and resale premiums down the line.

3. Strategic Location on Dwarka Expressway

Sector 103 sits right on the Dwarka Expressway — one of Gurgaon’s most dynamic and fastest appreciating residential corridors. This road provides excellent connectivity to Delhi, IGI Airport, South and West Delhi, and major employment hubs like Cyber City, making it ideal for both end-use buyers and investors.

Understanding ROI: Capital Gains + Rental Income

Return on Investment (ROI) in real estate comes from two key sources:

1. Capital Appreciation

Dwarka Expressway’s property values have surged significantly over the past few years. According to industry data:

-

Property prices along the expressway nearly doubled in 4 years (2020–2024) — a strong indicator of capital appreciation potential.

-

Experts now expect continued price growth of 15–20% annually for well-located and quality projects as infrastructure develops and connectivity improves.

For a branded luxury product like Westin Residences, the premium positioning and limited inventory could see above-average appreciation compared to generic projects, especially once metro connectivity and supporting infrastructure are fully in place.

2. Rental Yield and Income Potential

Rental yields in Dwarka Expressway are currently competitive with other NCR markets:

-

Typical residential rental yields in the corridor range from 2.6% to 3.7% for apartments, depending on the micro-location and quality of the society.

-

High-end luxury properties often see higher rent premiums due to strong demand among corporate professionals, NRI tenants, and expats.

While luxury apartments come with higher ticket sizes, they also command premium rents, especially given the proximity to major corporate hubs — making them attractive for buy-to-let investors.

Detailed Investment Factors: Beyond Basic ROI

Location Growth Drivers

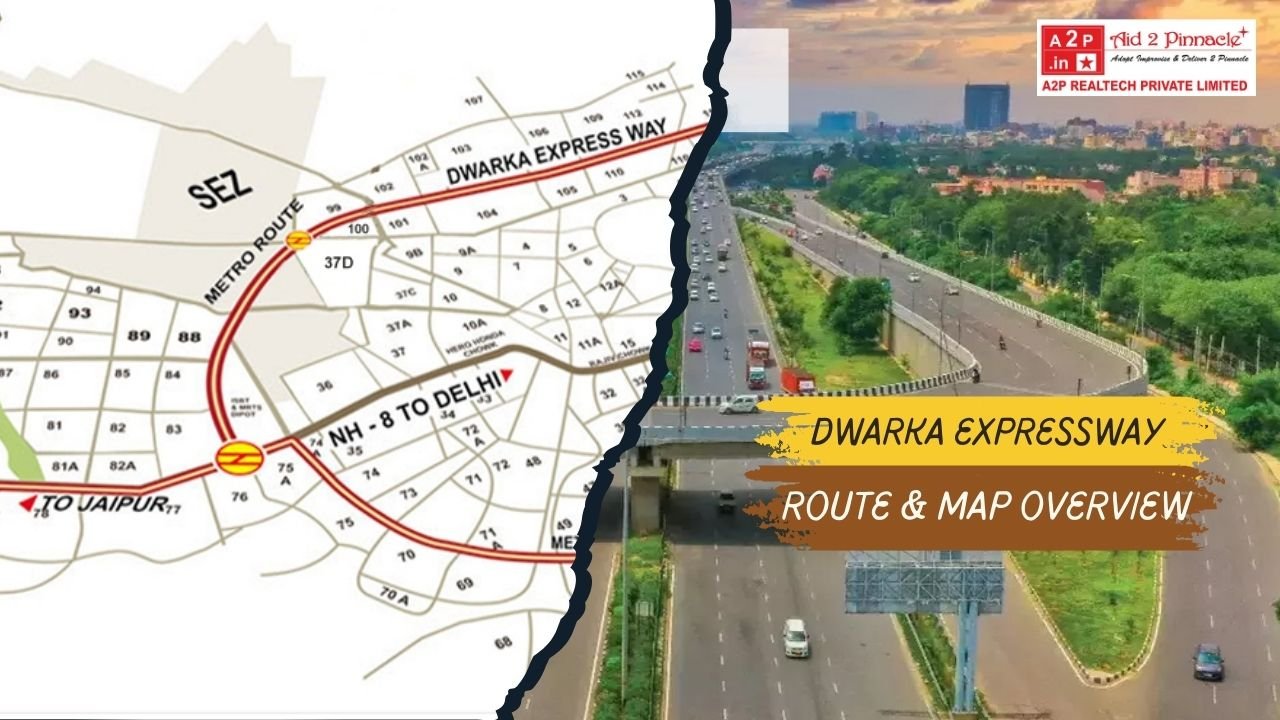

Dwarka Expressway has transformed from a peripheral road to a growth engine for NCR real estate due to:

-

Full operational connectivity to Delhi and IGI Airport.

-

Expected Direct Metro Connectivity (Blue Line extension) by 2026-27 — a major catalyst for property value.

-

Expansion of social infrastructure: schools, hospitals, retail and hospitality zones.

These improvements boost not only capital values but also end-user demand, stabilising the market beyond speculative investment.

Price Dynamics and Premium Positioning

Westin Residences is positioned in the luxury segment, with configurations like 3 & 4 BHK spanning ~2537 to 4329 sq. ft.

The branded positioning, amenities, and service-oriented features give it differentiation — which in real estate often translates into stronger long-term ROI.

Rental Demand and Tenant Profile

Investors should consider:

-

Corporate occupancy due to proximity to Gurugram’s employment corridors.

-

International travellers or expats looking for premium furnished homes — aided by Westin’s hospitality services.

-

Young professionals and families seeking lifestyle preferences and long-term rentals.

Properties with branded hospitality integration usually attract higher-quality tenants with longer stays, supporting sustained rental cash flow.

Risk Factors and Considerations

No investment is without risks. A few realistic factors to consider:

-

High ticket size means initial cash outlay is significant; ROI may take time to realise.

-

Rental yields on luxury projects may appear lower (%) compared to mid-segment homes due to higher prices — but they generate strong absolute returns due to premium rent levels.

-

Infrastructure timelines (like metro) can impact near-term price movements if delayed.

A balanced evaluation between capital appreciation and rental income stability is essential.

ROI Snapshot: The Numbers You Should Know

| Parameter | Indicative Metric |

|---|---|

| Dwarka Expressway price trend (2020–24) | Prices nearly doubled |

| Expected medium-term price growth | ~15-20% annual potential |

| Rental yield range on corridor | ~2.6%-3.7% |

| Premium community demand | High due to brand + amenities |

Note: Actual ROI varies by purchase price, timing, and individual negotiation.

Is Westin Residences Sector 103 a Good Investment?

If you’re a long-term investor seeking:

-

Capital appreciation in a fast-growing corridor

-

Premium positioning with brand value

-

Strong tenant demand for quality rentals

-

Lifestyle-oriented luxury living

Then Westin Residences Sector 103 on the Dwarka Expressway stands out as a high-potential real estate investment. Its combination of location, amenities, brand cachet, and connectivity make it ideal for both wealth creation and portfolio diversification over the next decade.

Latest Posts

-

-

by Admin Exploring the Most Exciting Ne...

-

by Admin Sobha 63A Golf Course Gurgaon ...

-

by Admin The Survival of Affordable Hou...

-

by Admin Gurgaon to Delhi Airport dista...

-

by Admin Why Gurgaon Is the Future of L...

-

by Admin Is Gurgaon a Good Place to Inv...

-

by Admin How to Buy Property in Gurgaon...

-

by Admin Gurgaon Luxury Real Estate Gui...

-

by Admin Why A2P Realtech Is the Best C...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Best Real Estate Company in Gu...

-

by Admin Is Gurgaon property safe under...

-

by Admin How to Choose the Right Real E...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin Why Gurgaon Real Estate Is Att...

-

by Admin Why Local Expertise Matters in...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Is Gurgaon better than South D...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin How close is Gurgaon to Delhi ...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Why Invest in Smartworld GIC G...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Is buying property in Gurgaon ...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...