S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

Blogs

Social Media Share

ROI of MVN Aero One in Sector 37D

In the ever-evolving landscape of real estate, understanding the potential return on investment (ROI) is key to making informed decisions. MVN Aero One, situated in the vibrant Sector 37D along Dwarka Expressway, Gurugram, stands out as a promising venture for investors and homeowners alike. With its strategic location, top-notch amenities, and modern design, this development not only promises a lifestyle replete with convenience but also offers a lucrative opportunity for capital appreciation. Dive into this insightful exploration as we uncover the compelling reasons why investing in MVN Aero One could be your next smart move. From market trends to potential rental income, we’ll guide you through the factors that enhance its ROI, turning your aspirations into reality. Whether you're a seasoned investor or a first-time buyer, discover how this property is set to redefine your real estate portfolio.

ROI Snapshot for MVN Aero One

- Average Rental Yield: Estimated between 2.5% to 3.5% annually

-

Capital Appreciation (1-Year): Approximately 31% increase in property value

-

Possession Timeline: As per Rera

Property Overview

MVN Aero One offers ultra-luxury 5.5 BHK apartments ranging from 6,300 to 12,600 sq. ft., with penthouses up to 13,500 sq. ft. Designed by renowned architect Hafeez Contractor, the project boasts 270° to 360° panoramic views, smart home automation, and premium amenities. The development spans 7.75 acres, with 50% open space, and is strategically located along the Dwarka Expressway, providing excellent connectivity to Delhi and Gurgaon.

Investment Highlights

-

High Capital Appreciation: The project's average price per sq. ft. has increased by approximately 31% over the past year, reflecting strong demand and investor confidence

- Strategic Location: Proximity to key areas such as IGI Airport, Cyber City, and Diplomatic Enclave II enhances the property's appeal for both end-users and investors .

Overview of Sector 37D, Gurugram

-

Location: Sector 37D is a rapidly developing residential and commercial sector along the Dwarka Expressway, Gurugram.

-

Connectivity: It enjoys excellent connectivity to Delhi, Gurgaon city center, IGI Airport, and the National Highway 48 (NH-48).

-

Real Estate Profile: The sector features premium residential projects with luxury apartments, villas, and gated communities from reputed developers.

-

Infrastructure: Modern infrastructure with wide roads, parks, schools, hospitals, and shopping centers under development or operational.

-

Demand Drivers: Proximity to business hubs like Cyber City, IGI Airport, and the Diplomatic Enclave boosts demand for high-end residences.

-

Growth Potential: The sector is part of the Dwarka Expressway growth corridor, making it a hotspot for real estate investments due to expected infrastructure upgrades and new metro connectivity.

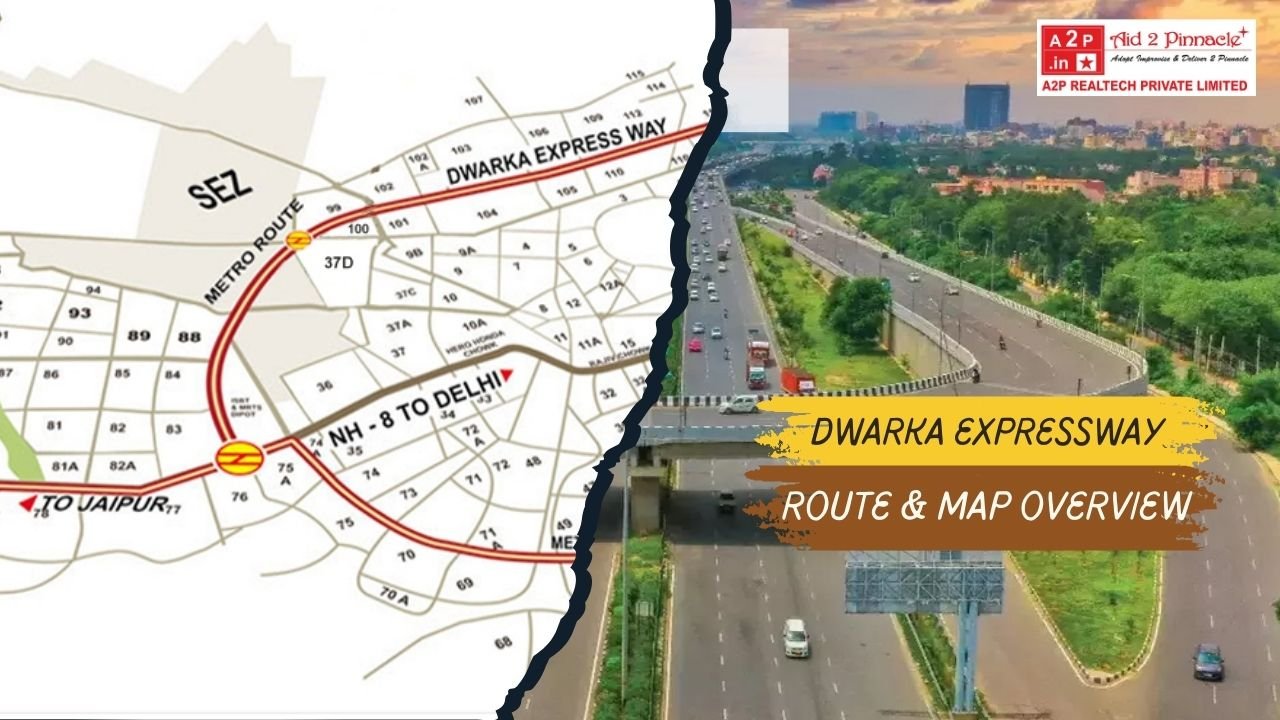

Overview of Dwarka Expressway

-

Length & Route: Dwarka Expressway (also called NH-248-BB) is approximately 27 kilometers long, connecting Dwarka in Delhi to Gurugram.

-

Purpose: It is designed to reduce traffic congestion on NH-48 and provide quicker access to IGI Airport and Gurugram.

-

Development Status: Significant portions are operational, with ongoing work to complete the full stretch, including elevated corridors and metro extensions.

-

Real Estate Corridor: The expressway has emerged as a prime real estate corridor with numerous residential and commercial projects by top developers.

-

Advantages:

-

Improved connectivity to Delhi, Gurgaon, Manesar, and the airport.

-

Well-planned infrastructure with better roads and facilities.

-

Availability of spacious residential projects offering luxury and affordability.

-

-

Future Prospects: The upcoming metro line extension and commercial developments will enhance the area's appeal and property values.

Overview of the key features of MVN Aero One in Sector 37D, Dwarka Expressway, Gurugram:

Project Overview

-

Developer: MVN Infrastructure

-

Configuration: Ultra-luxury 5.5 BHK apartments

-

Unit Sizes: Ranging from 6,300 sq. ft. to 13,500 sq. ft.

- Possession Timeline: As per Rera

-

Design & Construction

-

Architectural Design: Designed by renowned architect Hafeez Contractor, featuring iconic towers with modern aesthetics.

-

Structure: RCC structure with aluminum shuttering; compliance with seismic zone II standards.

-

Flooring: Premium Italian or imported marble in living areas; vitrified tiles or laminated wooden flooring in bedrooms.

-

Walls & Ceilings: Premium emulsion paint on walls; oil-bound distemper or emulsion paint on ceilings.

-

Kitchens & Bathrooms: Modular kitchens with L-shaped countertops; granite counters in bathrooms; superior quality ceramic tiles.

Amenities & Lifestyle Features

Rooftop Amenities

-

Infinity Pool: Temperature-controlled for year-round use.

-

Hot Tub & Massage Pavilion: Designed for relaxation and rejuvenation.

-

Sunken Court & Raised Pavilion: Ideal for social gatherings and events.

-

Multipurpose Court & Kids Play Area: Catering to recreational activities for all age groups.

Ground Floor Amenities

-

Fitness & Wellness: State-of-the-art gymnasium, outdoor gym, yoga & meditation lawn, spa.

-

Sports Facilities: Tennis court, basketball court, table tennis, skate park.

-

Social Spaces: Multipurpose hall, amphitheater, co-working space, conference room.

-

Healthcare & Convenience: Doctors' room/clinic, medical shop, salon, e-library.

-

Security & Parking: Five-tier security system, car parking, electric car charging points.

Connectivity & Location Advantages

-

Proximity to Key Areas:

-

Dwarka Expressway: 2 km

-

Pataudi Road: 1 km

-

Hero Honda Chowk (NH-8): 6 km

-

Huda Metro Station: 13.5 km

-

-

Nearby Educational Institutions:

-

Euro International School: 800 m

-

Suncity School: 800 m

-

Green Field School: 1 km

-

-

Healthcare Facilities:

-

The Signature Advanced Super Speciality Hospital: 300 m

-

Medanta-The Medicity: 9 km

-

SGT Hospital: 1 km

-

Residential Features

-

Spacious Layouts: Open-plan living areas with floor-to-ceiling windows offering panoramic views.

-

Private Elevators: Two dedicated elevators per apartment for enhanced privacy and convenience.

-

Customizable Residences: Options to personalize interiors to suit individual preferences.

-

Air Quality: Treated fresh air system for a healthier living environment.

Investment Potential of MVN Aero One

Investing in MVN Aero One in Sector 37D, Dwarka Expressway, Gurugram presents a compelling opportunity for high-net-worth individuals and discerning investors. Here's an in-depth look at the investment potential:

Strong Capital Appreciation

-

Strategic Location: The project's placement along the Dwarka Expressway enhances its desirability, contributing to sustained demand and potential for future value appreciation.

Integrated Mixed-Use Development

-

MVN Aero One Mall: The adjacent mall spans 1.5 million sq. ft. and includes a 300,000 sq. ft. co-working space leased to Spring House, indicating strong commercial interest .

-

Amenities: The development offers a range of upscale amenities, including a spa, gymnasium, swimming pool, and 24x7 security, enhancing its appeal to potential tenants and buyers.

Connectivity & Infrastructure

-

Dwarka Expressway: The expressway provides seamless connectivity between Delhi and Gurugram, reducing commute times and enhancing accessibility.

-

Proximity to Key Areas: MVN Aero One is strategically located near IGI Airport, Cyber City, and other commercial hubs, making it attractive to professionals and expatriates.

Estimated Return on Investment (ROI)

-

Rental Yield: Luxury properties in the vicinity offer rental yields ranging from 2.5% to 3.5% annually.

-

Capital Appreciation: Given the sector's growth trajectory and infrastructural developments, a conservative estimate of 5% annual appreciation is reasonable.

-

Total ROI Estimate: Combining rental yield and capital appreciation, investors can anticipate a total ROI of approximately 7.5% annually.

Factors Influencing ROI in Real Estate

Key factors influencing ROI in real estate investments, especially relevant to projects like MVN Aero One and similar developments:

Key Factors Influencing ROI in Real Estate

1. Location

-

Proximity to business hubs, airports, schools, hospitals, and transport facilities boosts demand.

-

Neighborhood safety, future development plans, and accessibility matter a lot.

2. Property Type and Quality

-

Luxury or premium properties often have higher appreciation potential but may have longer vacancy periods.

-

Construction quality, architectural design, and modern amenities attract buyers and tenants.

3. Market Conditions

-

Real estate market cycles (boom, slowdown, recovery) affect price appreciation and rental demand.

-

Economic indicators like interest rates, inflation, and employment rates impact property values.

4. Demand and Supply Dynamics

-

High demand coupled with limited supply drives up prices and rental yields.

-

Over-supply or market saturation can lead to price stagnation or declines.

5. Rental Yield

-

Rental income relative to property value contributes to overall ROI.

-

Location, tenant profile, and property condition influence achievable rental rates.

6. Capital Appreciation

-

Growth in property value over time depends on location development, infrastructure, and market trends.

-

Government initiatives like new metro lines or highways can spur appreciation.

7. Holding Period

-

Real estate typically appreciates over longer holding periods (5+ years).

-

Short-term flipping may yield profits but carries higher risk.

8. Financing and Costs

-

Interest rates on loans and availability of attractive financing options affect cash flow and ROI.

-

Additional costs like maintenance, property tax, and transaction fees reduce net returns.

9. Regulatory Environment

-

Changes in property laws, tax incentives, and RERA compliance impact investor confidence and returns.

-

Clear titles and legal due diligence minimize risks.

10. Developer Reputation

-

Established developers with a track record deliver quality projects on time, ensuring better ROI.

-

New or unproven developers pose higher risk but may offer lower entry prices.

Investor Testimonials & Case Studies for Sector 37D

1. Testimonial: Mr. Rajesh Sharma, Gurugram

. The location near Dwarka Expressway and the top-notch amenities give me confidence about the long-term value. The developer’s reputation also helped ease my concerns."

2. Testimonial: Ms. Neha Kapoor, Delhi

"I was looking for a luxury home close to the airport and IT hubs. MVN Aero One’s design by Hafeez Contractor and the lifestyle amenities convinced me to invest. The project offers great rental yield potential, and with the metro extension planned nearby, I believe it will attract premium tenants."

3. Case Study: Early Investment in Dwarka Expressway (2018-2023)

-

Investor: Mr. Ravi Shekhar, NRIs

-

Outcome: Property value appreciated by over 40% in 5 years due to infrastructure development and metro connectivity plans.

-

Lesson: Early investments in emerging corridors with good developer backing yield higher capital gains.

5. Testimonial: Mr. Sunil Mehta, Investor

"I diversified my portfolio by investing in residential and commercial spaces at MVN Aero One. The integrated mall and co-working spaces add commercial value, enhancing overall returns beyond just residential appreciation."

Is MVN Aero One Worth the Investment?

Pros

-

Prime Location:

Situated in Sector 37D along the rapidly developing Dwarka Expressway, with excellent connectivity to Delhi, Gurugram, IGI Airport, and major business hubs. -

Luxury & Design:

Designed by renowned architect Hafeez Contractor, the project offers ultra-luxury 4.5 and 5.5 BHK apartments with premium finishes and spacious layouts. -

High Capital Appreciation Potential:

The area has shown significant price growth due to infrastructure development and metro expansion plans, promising solid long-term appreciation. -

Strong Developer Reputation:

MVN Infrastructure is known for delivering quality projects, adding a layer of trust and reducing project risk. -

Integrated Development:

Presence of commercial components like MVN Aero One Mall enhances lifestyle options and potential rental demand, boosting investment returns. -

World-Class Amenities:

Offers state-of-the-art facilities such as infinity pools, fitness centers, spa, sports courts, and smart home automation.

.jpg)