S-3 2nd floor Malik plaza plot No -5 sector 4 Dwarka New Delhi 110078

- Home

- /

- Why Indiabulls Nest Is the Pre...

Blogs

Why Indiabulls Nest Is the Pre Launch You Can not Miss

Indiabulls Nest, Sector 104 Dwarka Expressway: Pre‑Launch Booking at ₹13,000/ft², Payment Plan, Location Advantages & ROI

In the evolving real estate map of Delhi NCR, Dwarka Expressway has emerged as one of the hot corridors for premium residential developments. Among its newest offerings is Indiabulls Nest (also known as Indiabulls Estate & Club / Heights) located in Sector 104, Gurgaon. With its announcement of pre‑launch booking at approximately ₹13,000 per sq ft, luxurious amenities, and a strategic location, Indiabulls Nest is capturing the attention of both end‑users and investors.

This article goes deep into what makes this project stand out: the location benefits, payment schedules, booking amount, expected Return on Investment (ROI), advantages of pre‑launch booking, and risks to consider. If you are considering buying early or investing, read on to understand whether this could be the smart move for you.

1. Location & Strategic Benefits

Connectivity

-

The project is located right on Dwarka Expressway, ensuring strong connectivity to Gurgaon, Delhi, and the IGI Airport. Indiabulls Estate & Club claims about 15 minutes to IGI Airport.

-

Access to major business hubs like Cyber City, Aerocity, and the Diplomatic Enclave is relatively convenient.

-

Several reputed schools, hospitals, and shopping malls are in close proximity.

Green Spaces & Environment

-

Spread across ~17 acres with over 7 acres devoted to landscaped greens.

-

The project emphasises “resort‑style living” with open gardens, walking/jogging tracks, adventure park, pet park etc.

Amenities & Lifestyle Offerings

-

The clubhouse (called Waves) spans ~2 acres, with facilities like indoor & outdoor swimming pools (including temperature‑controlled indoor pool), spa, gymnasiums, sports facilities (tennis, padel, squash, etc.).

-

Premium finishes: imported marble / high‑quality materials, modular kitchens, VRV AC, high ceiling, large windows for natural light, etc.

Infrastructure & Future Growth

-

Dwarka Expressway’s infrastructure is improving, with better access roads, metro proposals, etc., boosting property values.

-

Recent reports show that prices in the Dwarka Expressway corridor have nearly doubled over 4 years, rising from ~₹9,434/sq ft in 2020 to ~₹18,668/sq ft in 2024.

2. Pricing, Booking Amount & Payment Plan

Pre‑launch Booking Price & BSP

-

The project’s pre‑launch booking rate is being floated around ₹13,000 per sq ft in some promotions. (Hypothetical / early offer; builder’s official BSP for release is higher.)

-

The launch BSP (basic sale price) in similar Indiabulls Estate & Club units is ~ ₹18,000 per sq ft with an inaugural discount ~ ₹500/sq ft.

Payment Plan Options

-

Indiabulls is offering flexible payment plans. One plan mentioned is 30:30:40 (i.e. 30% up front / during early stages, 30% in mid‑stage milestones, rest 40% on latter stages / possession) for some configurations.

-

Another structure (for Indiabulls One 104) includes:

-

10% within 30 days of allotment,

-

10% at 60 days,

-

10% at 120 days,

-

10% on completion of 22nd floor,

-

10% on superstructure completion,

-

20% on application of OC,

-

20% on receipt of OC,

-

10% on possession.

-

-

Extra charges to keep in mind: PLC (Preferential Location Charge), parking, club membership, maintenance, EDC/IDC etc. These may not always be included in the quoted price.

3. ROI & Capital Appreciation Potential

Historical Price Trends in Dwarka Expressway

-

As mentioned above, property prices along the expressway have nearly doubled in 4 years from ~₹9,400 to ~₹18,600 per sq ft.

-

This shows strong past demand, and gives a baseline for what might happen with premium launches.

Expected Appreciation for Indiabulls Nest

-

If you book early at ~₹13,000 per sq ft (pre‑launch), when BSP becomes ₹18,000 (or higher) at launch, that's an initial discount of ~30‑35% on BSP. This immediate “paper gain” plus demand for units with premium amenities means the value may rise further.

-

Over the next 3‑5 years, given infrastructure upgrades (roads, metro connectivity, airport, commercial development), prices may appreciate to ~₹22,000‑₹25,000 (or more), depending on area and demand. This implies capital gain of ~ 50‑80% over 5 years from pre‑launch booking cost (depending on final cost and holding period).

Rental Yield

-

Luxury units tend to have lower yields relative to cost, but in areas adjacent to corporate hubs and business districts, the demand for high end rentals is strong.

-

A 3 BHK + Utility unit might fetch monthly rent depending on finishes, furnishings, and exact location—in many comparable sectors of Dwarka Expressway, rents may be in the range of ₹1‑1.5 lakh or more per month for a premium unit of 2100‑2500 sq ft.

Net ROI (Holding Period & Costs)

-

Consider holding period of 4‑6 years to maximise benefit. During that time, you pay installments, maintenance etc., but also benefit from infrastructure maturation.

-

After accounting for taxes, maintenance, brokerage etc., net gains might reasonably be ~ 35‑60% over 4‑5 years, possibly more if the location gains further connectivity (metro, road widening, etc.).

4. Benefits of Pre‑Launch Booking at ₹13,000/sq ft

-

Lower Entry Price: Booking early at ₹13,000/sq ft gives you a price advantage over later buyers who pay full BSP. You lock cost before inflation, land cost, material cost increase.

-

Better Selection of Units: Early bookers often get priority in choosing floors, corners, views, orientation, tower placement etc.

-

Flexible Payment Terms: Builders usually offer more favorable payment schedules for early buyers, sometimes with more grace period before you need to pay large chunks.

-

Higher Appreciation Potential: Early buyers tend to benefit from the full wave of appreciation, since you’re entering near the bottom of price rise cycle.

-

Perks & Discounts: Pre‑launch buyers may get added incentives—discounts, waived charges (PLC, certain club fees), freebies, or preferential parking etc.

5. Costs, Risks & What to Verify

-

Construction & Possession Delays: Even for reputed builders, large luxury projects take time. Delays could affect financial planning.

-

External Infrastructure Delays: Metro, access roads, connecting roads, utilities may lag, reducing convenience until completed.

-

Hidden Costs: PLC (location premium), parking charges, EDC/IDC, GST, registration fees, club membership, maintenance, etc. Always get full cost sheet.

-

Higher Upfront Payments: Booking + initial installments may tie up a significant cash amount; interest cost or opportunity cost of funds should be considered.

-

Market Slowdown Risk: Macro environment, interest rates, policy changes can affect real estate demand and prices.

-

Builder Reputation & Legal Clearances: Ensure RERA registration, land titles, permits, and builder’s track record.

6. Sample Scenario / Financial Illustration

Let’s do a sample calculation using these assumed numbers:

-

Unit: 3 BHK + Servant, ~2,100 sq ft

-

Pre‑launch rate: ₹13,000/sq ft → Total cost ~ ₹2.73 Crore

-

Booking amount: Typically ~10‑20% of total cost → assume 10% → ₹27.3 Lakhs

-

Payment Plan: 30:30:40 (30% upfront, next 30% during mid construction, 40% at possession)

-

Booking: ₹27.3 Lakhs

-

-

Scenario after 5 years: Assume property price rises from ₹13,000 to ₹24,000 per sq ft (depending on infrastructure, demand). New value = 2,100 × 24,000 = ₹5.04 Crore.

-

Capital Gain: ₹5.04 Cr ‒ ₹2.73 Cr = ₹2.31 Crore gain over 5 years.

7. Why Indiabulls Nest (Estate & Club / Heights) Stands Out

-

Strong developer branding: Indiabulls has experience in luxury projects and delivering premium amenities.

-

Resort‑style amenities & services in this project (clubhouse, pools, sports, green open spaces) are among top in this price / sector‑class.

-

Low‑density layout (few units per floor, large open spaces) adds exclusivity.

-

Strategic timeline: being pre‑launch, you can enter at lower price, lock in rates & benefit when infrastructure catches up.

-

Sector 104 is emerging rapidly: price appreciation, connectivity, demand, all trending upward. The Dwarka Expressway corridor’s past growth and predicted demand strengthens this.

Indiabulls Nest (Estate & Club / Heights) in Sector 104, Dwarka Expressway presents a compelling opportunity if you act early. Booking at ~₹13,000/sq ft in the pre‑launch phase brings cost savings, better unit selection, and strong upside potential. While you should account for risks—especially regarding infrastructure, hidden costs, and possession delays—the location, luxury amenities, and price trends in the Dwarka Expressway corridor suggest that total returns (capital appreciation + rental yield) over a 4‑6 year horizon can be very attractive.

Latest Posts

-

-

by Admin Exploring the Most Exciting Ne...

-

by Admin Sobha 63A Golf Course Gurgaon ...

-

by Admin The Survival of Affordable Hou...

-

by Admin Gurgaon to Delhi Airport dista...

-

by Admin Why Gurgaon Is the Future of L...

-

by Admin Is Gurgaon a Good Place to Inv...

-

by Admin How to Buy Property in Gurgaon...

-

by Admin Gurgaon Luxury Real Estate Gui...

-

by Admin Why A2P Realtech Is the Best C...

-

by Admin Top Real Estate Trends Investo...

-

by Admin Best Real Estate Company in Gu...

-

by Admin Is Gurgaon property safe under...

-

by Admin How to Choose the Right Real E...

-

by Admin Flats Near Dwarka Expressway

-

by Admin Villas on Dwarka Expressway Gu...

-

.jpg)

by Admin Live Like Royalty Explore The ...

-

by Admin Why Gurgaon Real Estate Is Att...

-

by Admin Why Local Expertise Matters in...

-

by Admin SOBHA STRADA High Return Servi...

-

by Admin New Flats on Dwarka Expressway...

-

by Admin Is Gurgaon better than South D...

-

by Admin Project Overview of Neo Square...

-

by Admin Why Whiteland Westin Residence...

-

by Admin Krisumi Waterside Gurgaon New ...

-

by Admin Eldeco Sector 17 Dwarka Delhi ...

-

by Admin New Launch Luxury Properties o...

-

by Admin Hero Homes Luxury Flats on Dwa...

-

by Admin Exclusive Penthouses for Sale ...

-

by Admin Westin Residency ROI Breakdown...

-

by Admin Top Reasons Why BPTP Gaia Resi...

-

by Admin The Palatial by Hero Homes in ...

-

by Admin Buy 3BHK Flat on Dwarka Expres...

-

by Admin Build Your Commercial Building...

-

by Admin Discover Unbeatable Offers on ...

-

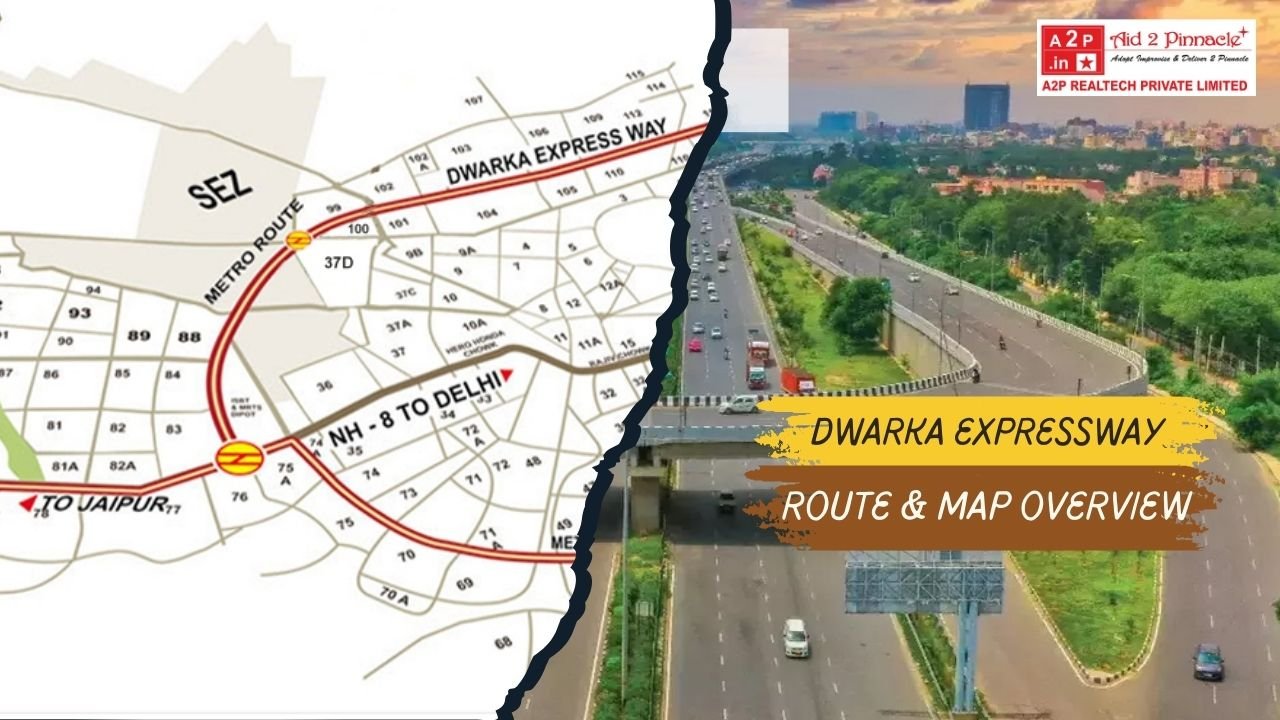

by Admin Dwarka Expressway Gurgaon Over...

-

by Admin Exclusive 3 BHK Luxury Apartme...

-

by Admin Explore Premium Flats at Tashe...

-

by Admin ROI Opportunities in Elan Pres...

-

by Admin How to Secure Your Dream Unit ...

-

by Admin Luxurious 3 BHK Apartments wit...

-

by Admin Luxury 2 BHK Apartments for Sa...

-

by Admin Luxury Living Experience in Th...

-

by Admin New Launch Elan The Emperor Se...

-

by Admin Best ROI on Dwarka Expressway ...

-

by Admin ROI of Sobha Altus Sector 106 ...

-

by Admin How A2P Realtech Can Help You ...

-

by Admin The Ultimate Guide to Book Ren...

-

by Admin A2P Realtech is the best Prope...

-

by Admin Why Dwarka Expressway is the B...

-

by Admin Dwarka Expressway Gurgaon Take...

-

by Admin Top SCO Projects for Sale on D...

-

by Admin How close is Gurgaon to Delhi ...

-

by Admin Is It Worth Investing Neo Squa...

-

by Admin 3 BHK Flats on Dwarka Expres...

-

by Admin Top Villa Projects on Dwarka E...

-

by Admin Earn from Day One Invest in Vi...

-

by Admin Indiabulls Breaks Price Barrie...

-

by Admin Perfect for Family Living 3 BH...

-

by Admin AIPL Lake City Sector 103 Gurg...

-

by Admin Your Trusted Real Estate Partn...

-

by Admin Dwarka Expressway Gurgaon prop...

-

by Admin Dwarka Expressway Gurgaon Map ...

-

by Admin Invest in Lockable Shops Under...

-

by Admin Discover Luxurious 3 BHK Apart...

-

by Admin Hero Homes Gurgaon Best Luxury...

-

by Admin Buy 3BHK Flats or Apartments o...

-

by Admin Why Invest in Smartworld GIC G...

-

by Admin Dwarka Expressway Real estate ...

-

by Admin Best time to invest in m3m GIC...

-

by Admin Elan Imperial Sector 82 Gurgao...

-

by Admin SCO Plots on Dwarka Expressway...

-

by Admin Under‑Construction Projects ...

-

by Admin Ready to Move 3 BHK Flats on D...

-

by Admin Invest for the Future Impressi...

-

by Admin Dwarka Expressway Property Pri...

-

by Admin Unlock Elite Returns with A2P ...

-

by Admin Villas on Dwarka Expressway Lu...

-

by Admin Smart Investment Luxury 3 and ...

-

by Admin Luxury Homes on Dwarka Express...

-

by Admin Why Indiabulls Nest Is the Pre...

-

by Admin Top Ready to Move Flats Apartm...

-

by Admin Best Property on Dwarka Expres...

-

by Admin Right Time to Book 3 to 5 BHK ...

-

by Admin Best Real Estate Agents Channe...

-

by Admin Hero Homes Dwarka Expressway G...

-

by Admin Dwarka Expressway Luxury Proje...

-

by Admin Exploring Investment Options i...

-

by Admin Sonnar Bangla and A2P Realtech...

-

by Admin The Future of India Real Estat...

-

by Admin Unlocking the Best Deals How A...

-

by Admin High Rise Apartments on Dwarka...

-

by Admin Neha and Rohan Found Their Dre...

-

by Admin Durga Puja at Omaxe World Stre...

-

by Admin Sobha Studio Apartments Sector...

-

by Admin 4 BHK Flats on Dwarka Expressw...

-

by Admin Why High Rise Apartments Are T...

-

by Admin Homes Hubs and High Returns

-

by Admin Maximizing Your Investment Und...

-

by Admin The Impressive ROI of M3M Capi...

-

by Admin ROI of MVN Aero One in Sector ...

-

by Admin Best ROI Opportunities at M3M ...

-

by Admin ROI Growth Sobha City Sector 1...

-

by Admin The ROI Potential of Shapoorji...

-

by Admin Is buying property in Gurgaon ...

-

by Admin Best Under Construction Homes ...

-

by Admin 5 BHK Apartment on the Dwarka ...

-

by Admin Why The Palatial by Hero Homes...

-

by Admin New Launch Properties Near Dwa...

-

by Admin Upcoming 3BHK Apartments on Dw...

-

by Admin Luxury Apartments in Gurgaon K...

-

by Admin A High Potential Investment Op...

-

by Admin Considering Dream Homes in Dwa...

-

by Admin A2P Realtech deals in Luxury A...

-

by Admin A Luxurious Dream Home Awaits ...

-

by Admin The ROI of Investing in Chinte...

-

by Admin A Comprehensive Guide to Inves...

-

by Admin The ROI Benefits of Investing ...

-

by Admin Why Investing in Dwarka Expres...

-

by Admin ROI Analysis of M3M Mansion in...

-

by Admin Why M3M Capital Walk in Sector...

-

by Admin Buying home in festive season

-

by Admin M3M Mansion The Perfect Blend ...

-

by Admin Dwarka Expressway The Hottest ...